#memeconnect #vce

With the end of 2010 in sight, I’m taking a look forward at what is in store for the storage networking market in 2011 and beyond. To understand where the market is going, let’s level-set on the state of the industry and where the various solutions fit in the ecosystem.

The current storage networking market

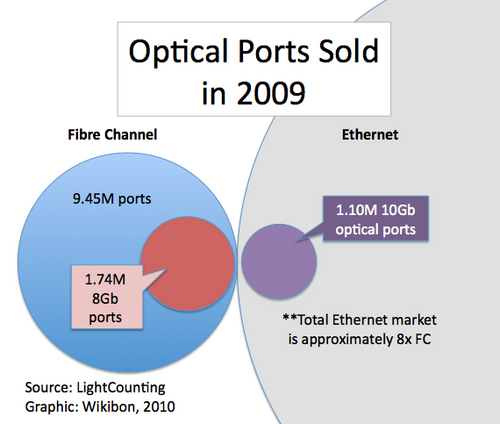

The storage networking market is made up of Fibre Channel (FC) and Ethernet. A prominent theme is that FC is dead and that Ethernet is taking over. The reality is that while convergence is a strong trend, and Ethernet is expected to be the “winner” for customers that want to move their environments to a single network, this trend will take many years to move the overall numbers. This graphic shows optical ports (combination of switches and host adapters) sold in 2009. Note that FC is all optical, 10Gb Ethernet was about 2/3 optical (before 2009, 10GbE was all optical, SFP+ and 10GBASE-T options are becoming more prevalent).

The point to draw from this data is that while the Ethernet market is much larger than FC, the transition to 10GbE is slow (10GbE revenue is surpassing 1GbE, but port counts of 10GbE will not surpass 1GbE in the next 5 years), and FC port shipments will continue to be larger than 10GbE for the next 3-5 years. On the adapter market, which is made up of colliding duopolies – Intel and Broadcom from the 1GbE market and Emulex and QLogic on the FC side – this means that 1GbE suppliers will not have a volume advantage in in the market in the next few years. See Competitive Positioning of Network Adapters for more on the converged network adapter (CNA/NIC) space. On the switch side, this means that Brocade will not see its revenue disappearing in 2011. FC sales have not declined in 2010 – surely some of the volume can be due to delayed purchases due to economic conditions in 2008 and 2009. In the next 1-2 years, FC revenues will be flat to negative, but if you consider that FCoE and FC are two halves of the same solution, then the outlook is less negative. Brocade does have a tough battle to try to move into a crowded Ethernet switch market.

Will 2011 End the Protocol Wars?

What is the proper networking protocol for storage in general and virtualization specifically? The answer is the one that fits a customer’s environment best. EMC’s Chad Sakac did a survey which showed that more than half of all customers use more than one protocol in their environments. The competition is not between iSCSI, FC, FCoE and NAS, but between these options and DAS. NetApp and EMC lead the way with a full “unified” storage message, including support for native FCoE storage.

FCoE is the new protocol on the block and is a good fit for enterprise customers (who are the users of FC today), so it gets a lot of coverage. Here’s what to expect with FCoE in 2011:

- Multi-hop configurations will appaer.

- Additional storage vendors will bring out native FCoE.

- Full end-to-end Ethernet will become possible (the VCE Coalition has the opportunity to offer the first turnkey solution once EMC native FCoE storage is baked into Vblock offerings).

- HP will support FCoE through its networking line (ToR and core switches – the A-Series), providing an alternative to Cisco and Brocade. Other Ethernet suppliers (Juniper, Arista, Force10, etc.) will support DCB/CEE, but may not release an FCoE product.

I’d like to see 2011 as the year when customers have the flexibility in solutions to use FC and Ethernet (with all of the block and file options) as needed. HP has moved first with a dynamic wire-once solution; Cisco is following fast, and the other server vendors are in various stages of catching up.

Predictions

2011 is a critical year for vendors in the transition to 10GbE and in the adoption of convergence. If server vendors adopt a flexible LOM solution such as Dell’s Network Daughter Card, the adapter vendors will need to battle for design wins and must increase brand awareness with end-users who will be given a choice in connectivity. Intel has the lead in brand awareness, while Emulex and QLogic are sticky with storage accounts that want to keep the same driver stack for FC and FCoE.

iSCSI is continuing to grow, and my prediction is that not only will FCoE not surpass iSCSI in ports in 2011, but since iSCSI tends to be in the mid-market and commercial segments, FCoE will never surpass iSCSI in ports sold.

I do believe that FCoE will expand in 2011, but I will not call it “the year of FCoE”. If FCoE is 10% of the overall SAN market in 2011, it should be considered it a huge success.

NAS solutions are continuing to grow, and while pNFS is an interesting solution, which is starting to get a lot of hype, the ecosystem needs another year or two to mature.

I predict that it will take 3-5 years for FC to become a niche solution (and even at that point, IBM can tell us that niche/"dead" technologies can provide significant revenue for many years) with Ethernet dominating the market. The protocols should end up ranked NAS > iSCSI > FCoE+FC; but converged solutions (CNAs, unified storage and flexible networking) will support all of these protocols.

As a final note, 40Gb and 100Gb Ethernet and 16Gb FC solutions will all enter the market in 2011, but as most customers are still working on the transitions to 10GbE and/or 8Gb FC, only the earliest adopters will need to consider these higher speeds next year.