While the wave of cloud computing has been part of the IT dialogue for the last five years, the ecosystem is still in the early phases of maturation. On the April 23, 2013 Peer Incite, Jason Mendenhall of the Vegas-based Switch cloud colocation facility said that the industry is still in the “VHS phase” (1.0 version) of cloud.

While Amazon does not break out its cloud revenues, it is generally understood that AWS is the leader in cloud with estimates that it could bring in over $3B in revenue for 2013. Amazon is not only the leader, but is a disruptor to other cloud services through frequent and rapid deployment of new features and services. Technology suppliers must not only mimic Amazon’s speed and ease, they must rapidly put forth the business case for an alternative that differentiates and clearly communicates why and how they are different.

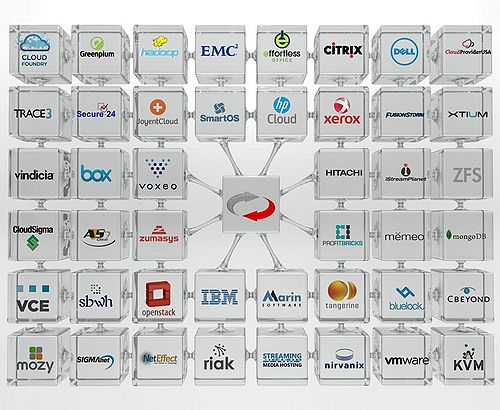

Jason Mendenhall spoke of how Switch brings together an inter-cloud exchange that delivers a broad ecosystem of cloud providers plus cross-connect capabilities. As the suppliers that Switch hosts look to win business away from Amazon, they should focus on things that Amazon can’t or won’t do. There is also immense opportunity to deliver on targeted cloud offerings that are targeted at specific vertical needs.

Here are four areas that vendors should look to for differentiation from Amazon AWS:

Performance: While Amazon continues to add options, not all clouds are created equal. Locality, network design and how compute and storage communicate are all important. Clouds/services need to compete with better performance overall in the design and the type of workloads that are best used in the environment.

Cost: Amazon and Google are racing each other down in price, but it is still very difficult to determine what real costs will be over time. Vendors can help customers choose the right solutions by offering transparency (it’s been said that Amazon is only cheap until you use it). The cost of moving data out of Amazon is colossal. Clarity of costs is key.

Control: Privacy, security, compliance, and alignment with governance requirements and/or corporate edicts is challenging. Vendors need to deliver appropriate reporting and a new wave of toolsets to monitor the environment. Visibility into application performance and control is absolutely crucial.

Support: SLAs must be transparent (easy to find on a public website) and better than Amazon. Having 24X7X365 phone support. Amazon is growing its channel to reach deeper into the enterprise.

Action Item: Amazon’s market position in cloud, rapid growth, speed of innovation and low margins make it a daunting competitor. Technology vendors and service providers can successfully compete; especially when they can be part of an ecosystem such as Switch has built. CIOs are looking for deeper relationships to find new value by using the cloud beyond simply lowering costs.

Footnotes: