Big Data Market Size and Vendor Revenues

From Wikibon

By Jeff Kelly with David Vellante and David Floyer

The big data market is on the verge of a rapid growth spurt that will see it top the $50 billion mark worldwide within the next five years.

As of early 2012, the big data market stands at just over $5 billion based on related software, hardware, and services revenue. Increased interest in and awareness of the power of big data and related analytic capabilities to gain competitive advantage and to improve operational efficiencies, coupled with developments in the technologies and services that make big data a practical reality, will result in a super-charged CAGR of 58% between now and 2017.

As explained in our Big Data Manifesto, big data is the new definitive source of competitive advantage across all industries. For those organizations that understand and embrace the new reality of big data, the possibilities for new innovation, improved agility, and increased profitability are nearly endless.

Below is Wikibon’s five-year forecast for the big data market as a whole:

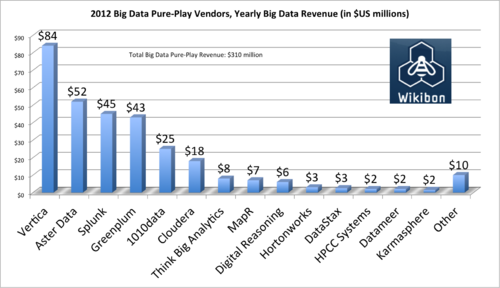

Of the current market, big data pure-play vendors account for $310 million in revenue. Despite their relatively small percentage of current overall revenue (approximately 5%), these vendors – such as Vertica, Splunk and Cloudera -- are responsible for the vast majority of new innovations and modern approaches to data management and analytics that have emerged over the last several years and made big data the hottest sector in IT.

Wikibon considers big data pure-plays as those independent hardware, software, or services vendors whose big data-related revenue accounts for 50% or more of total revenue. This group also consists of three until-recently independent next-generation data warehouse vendors – HP Vertica, Teradata Aster, and EMC Greenplum – that largely continue to operate as autonomous entities and have not, as of yet, had their DNA polluted by their acquirers.

Below is a worldwide revenue breakdown of the top big data pure-play vendors as of February 2012.*

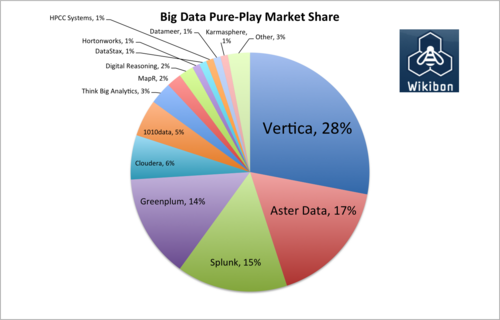

Below is a breakdown of market share among the pure-play segment of the big data market.

The current big data market leaders, by revenue, are IBM, Intel, and HP, these megavendors will face increased competition from established enterprise suppliers as well as the aforementioned big data pure-plays developing big data technologies and use cases that are driving the market. It is incumbent upon Hadoop-focused pure-plays, however, to establish a profitable business model for commercializing the open source framework and related software, which to date has been elusive.

Below is a breakdown of current total big data revenue by vendor**:

| Vendor | Big Data Revenue (in $US millions) | Total Revenue (in $US millions) | Big Data Revenue as Percentage of Total Revenue |

| IBM | $1,100 | $106,000 | 1% |

| Intel | $765 | $54,000 | 1% |

| HP | $550 | $126,000 | 0% |

| Oracle | $450 | $36,000 | 1% |

| Teradata | $220 | $2,200 | 10% |

| Fujitsu | $185 | $50,700 | 1% |

| CSC | $160 | $16,200 | 1% |

| Accenture | $155 | $21,900 | 0% |

| Dell | $150 | $61,000 | 0% |

| Seagate | $140 | $11,600 | 1% |

| EMC | $140 | $19,000 | 1% |

| Capgemini | $111 | $12,100 | 1% |

| Hitachi | $110 | $100,000 | 0% |

| Atos S.A. | $75 | $7,400 | 1% |

| Huawei | $73 | $21,800 | 0% |

| Siemens | $69 | $102,000 | 0% |

| Xerox | $67 | $6,700 | 1% |

| Tata Consultancy Services | $61 | $6,300 | 1% |

| SGI | $60 | $690 | 9% |

| Logica | $60 | $6000 | 1% |

| Microsoft | $50 | $70,000 | 0% |

| Splunk | $45 | $63 | 68% |

| 1010data | $25 | $30 | 83% |

| MarkLogic | $20 | $80 | 25% |

| Cloudera | $18 | $18 | 100% |

| Red Hat | $18 | $1,100 | 2% |

| Informatica | $17 | $750 | 2% |

| 1010data | $25 | $30 | 50% |

| SAS Institute | $15 | $2,700 | 1% |

| Amazon Web Services | $14 | $650 | 2% |

| ClickFox | $11 | $35 | 31% |

| Super Micro | $11 | $540 | 2% |

| SAP | $10 | $17,000 | 0% |

| Think Big Analytics | $8 | $12 | 167% |

| MapR | $7 | $7 | 100% |

| Digital Reasoning | $6 | $12 | 50% |

| Pervasive Software | $5 | $50 | 10% |

| Hortonworks | $3 | $3 | 100% |

| DataStax | $3 | $3 | 100% |

| Attivio | $2.5 | $19 | 13% |

| QlikTech | $2 | $300 | 1% |

| HPCC Systems | $2 | $2 | 100% |

| Datameer | $2 | $2 | 100% |

| Karmasphere | $2 | $2 | 100% |

| Tableau Software | $1.5 | $72 | 2% |

| NetApp | $1.5 | $5,000 | 0% |

| Other | $25 | n/a | n/a% |

| Total | $5,051 | $866,070 | 1% |

Wikibon initiated this research in an effort to provide some guidance to the community on the size of the market. Everyone is buzzing about big data, which begs the question: "How big is the big data market?" We searched but were unable to find any market size information and felt that putting forth a tops/down and bottoms/up analysis would be useful. Putting a 'stake in the ground' on the market size will also, we hope, generate further discussion in the community and help us fine-tune the market estimates. All credible input will be assessed and acted upon quickly.

Regarding methodology, the big data market size, forecast, and related market-share data was determined based on extensive research of public revenue figures, media reports, interviews with vendors and resellers regarding customer pipelines, product roadmaps, and feedback from the Wikibon community of IT practitioners. Many vendors were not able or willing to provide exact figures for our big data definition, and because many of the pure plays are privately held it was necessary for Wikibon to triangulate many sources of information to determine our final figures. Wikibon defines big data to include data sets whose size and type make them impractical to process and analyze with traditional database technologies and related tools. The big data market, therefore, includes those technologies, tools, and services designed to address these shortcomings. These include:

- Hadoop distributions, software, subprojects and related har