Ed Note: This is a "future history" of 3PAR and Dell set in 2015 and looking back on the meeting at which 3Par's senior executives decided to sell the company to Dell and on the "results" of that decision over the next five years. It is a fictional scenario however all efforts have been made to present accurate quantitative data.

Contents |

Introduction

At a board meeting in Mid-2010, David Scott, 3PAR’s CEO was grilled. It appeared the worst economic disaster since the Great Depression was over, and the directors wanted to know when and how the company would hit its objective of achieving $1B in revenue. The firm had just celebrated its 10th anniversary, and the tone of the room was intense. Scott had led the company to a successful IPO, and it was gaining share on the established players in the market. But it wasn’t growing fast enough.

3PAR has always been an innovator. It’s singular focus on simplifying storage by bringing virtualization, thin provisioning, and automated storage management to data center infrastructure was a fundamental component of infrastructure 2.0. The company’s vision of providing utility storage had been consistent since day one, and even though the name had changed (the market called it ‘the cloud’ back then) it was basically the same thing – rent, don't own, IT infrastructure.

3PAR bet early on that IT needed to be simpler and more efficient, and the best way for most customers to obtain infrastructure was as a service that hit the opex line and avoided expensive capital expenditures. 3PAR’s founders believed that those customers not buying IT as a service would have to look and act more like service providers, and 3PAR would be the infrastructure of choice.

By mid-2010, 3PAR was an ten-year-old company that generated about $200M in revenue. The company ran itself roughly at breakeven and had been investing in building out its technology portfolio and sales channel. The company had a clean balance sheet, a $600M market cap and was growing at a 2-year clip of around 26%. However it’s recent stock performance was being outpaced by most of its competitors. Why was that?

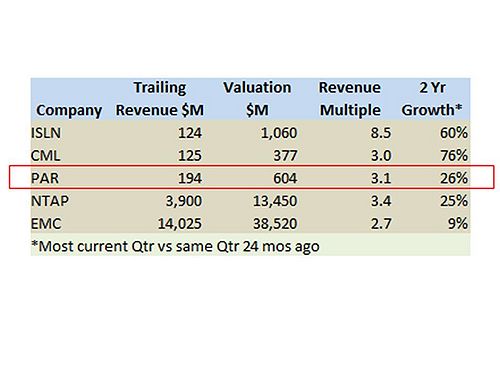

The answer was seen when placed side-by-side with the major pure plays in the storage business at the time. 3PAR didn’t stand out financially:

The board wanted to know why and what 3PAR could do about it. Scott was tasked with coming back to the board with answers at the next meeting.

Scott Goes Back to the Drawing Board

Scott embarked on a project with his senior managers to investigate their strategic options. He took them off-site to a hotel in Monterey, away from the office. He told his team he wanted to increase 3PAR’s valuation dramatically and wanted to know what paths it could take. He told his team that everything was on the table, including getting acquired.

Scott wanted to know, how could 3PAR compete with the big boys (EMC, IBM, and Hitachi) and grow more quickly? The bottom line challenge was to get 3PAR growing faster, taking more share and getting to a billion dollars in revenue.

The CEO’s Perspective

Scott kicked off the meeting. He told his team that in his view 3PAR needed to stay focused and continue to bet on its utility computing vision – what was then known as ‘the cloud.’ He said it was the company’s single best chance at hitting its objectives. He stressed that he didn’t think it was necessary to do something radical like becoming a service provider. Rather he said 3PAR should be the best possible arms dealer and the best supplier to service providers and the internal IT departments that needed to do more with less and become more efficient providers of IT as a service.

He told his team that two tectonic shifts were occurring within the IT industry:

- The move from distributed to utility-based computing (i.e. physically dedicated to secure multi-tenant sites).

- The transition from internal data center to externally hosted cloud infrastructure services.

His premise was that these shifts were fundamentally changing storage requirements by emphasizing two key attributes, agility – the ability to rapidly provision capacity and handle a diverse set of applications/workloads -- and efficiency – the ability to utilize assets more effectively to deliver lower operational costs.

Best of Breed or Integrated Stacks?

There was significant discussion at the 3PAR offsite about the so-called “Stack Wars,” meaning the integration of specific intellectual property by large vendors as a means of competing in the marketplace. Oracle had purchased Sun, Dell was buying companies like crazy, EMC had acquired Data Domain for $2B+, IBM had purchased XIV and Diligent, HP was on a storage and networking acquisition binge, and it appeared that intellectual property portfolios were becoming highly integrated. Meanwhile, 3PAR was basically a one-product company.

Scott’s head of sales said that the biggest problem they faced in the field was that the technology guys loved their solution, but CFOs, CIOs, and CEOs were nixing deals in favor of going with the big boys—the perceived “safe bet.” This was costing 3PAR many deals and was increasingly frustrating for the team. 3PAR had recently lost its head of sales to a startup, and several other excellent sales reps had left the company. They were able to fill the slots, but activities like establishing sales operational processes and managing productivity goals were taking time away from generating revenue.

3PAR’s head of R&D was incensed. He said that these C-level execs were risking their companies by sticking with technology that couldn’t deliver 3PAR’s levels of efficiency. He said these guys were ‘dinosaurs’, and they would eventually be out of jobs for costing their companies so much money. The head of sales repeated the bromide that no one gets fired for buying IBM (or EMC as was often the case).

Enter the Cloud

Cloud computing was all the rage in 2010. Cloud fever had gripped Silicon Valley and the broader IT community. It just made so much sense – why own depreciating assets when you could acquire IT as a service? So-called cloud service providers were doubling or tripling every year and internal IT departments were under huge pressure from CEOs to cut costs and improve operations.

Scott told his team that he believed both cloud service providers (CSPs) and large enterprises would be better served using best-of-breed technologies versus pursuing integrated stack approaches from the likes of IBM, HP, Oracle, and the VMware-led virtual stack advocated by EMC. His premise was that cloud service providers had two key requirements to win: They had to deliver the best service levels at the lowest transactional cost, and they needed to capture as much of the profit pool available from the emerging cloud tsunami.

His logic was that that to address the first, CSPs would pursue building their own best-of-breed stacks as a means of differentiation, and using what Scott called “sub-optimized, vertically integrated stacks” would lead them to be marginalized. He believed that to achieve the second, CSPs would need to avoid the lock-in of broad suppliers’ vertical stacks, which would prevent them from maintaining pricing power and making more profit.

Scott believed that large IT shops ultimately would come to the same conclusion as CSPs. Specifically, because they would increasingly be measured based on service levels, cost, and agility, internal enterprises building what at the time were called private clouds (internal clouds with the economics of IT as a service) would choose to adopt best-of-breed solutions.

The Counter Argument

Lots of discussion ensued. Some of 3PAR’s executives dissented, saying they were believing their own propaganda. They argued with Scott that service providers had historically purchased a little bit of everything from all major suppliers. The argument was they could successfully mix-match-and-manage infrastructure because they had integration expertise and were set up for a business model that charged back to their customers. The customer wanted a capability, and CSPs could deliver it for a fee, arbitraging their pricing power and integration expertise.

The essential argument was that partnering and having relationships with multiple technology providers had always served the CSP crowd well, and all of 3PAR’s competitors would successfully sell to CSPs. It was unlikely, this group argued, that service providers would standardize on a single platform. Rather, they would hedge their bets and engineer solutions using a ‘horses for courses’ mentality.

Internal IT providers, the dissenters argued, were increasingly trying to standardize on infrastructure and very well might migrate toward more integrated platforms. They didn’t have to be head-to-head as good as CSPs, they just needed to be good enough. The argument was that to the extent the vertically integrated stack vendors provided adequate services, customers would continue to buy from the ‘safe bet’ company.

It was a conundrum for 3PAR that put them right back where they started—a minnow fighting whales.

CSPs as the Primary Focal Point

Scott acknowledged the argument but pointed out that recent evidence favored Scott’s best-of-breed argument as witnessed by the growth rates of firms like 3PAR, NetApp, Compellent and Isilon, who at the time were growing at 25%-75% whereas EMC was growing in the high single digits. Clearly the focused pure-play model was winning, and when it came to the optimal combination of simplicity, efficiency, and performance, for block-based workloads—3PAR was best-of-breed.

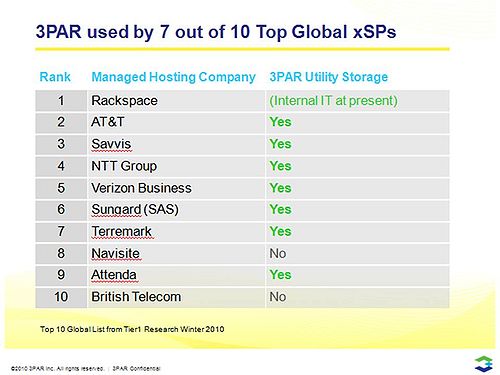

3PAR’s head of marketing put up a slide that showed 3PAR had penetrated seven of the ten leading CSP’s. Here’s a copy of that slide from the now-famous meeting that day in Monterey:

The team agreed – focusing on cloud service providers and being the best possible supplier to these firms would confer advantage to 3PAR. If they could win in that market space, they could reach new small and mid-sized markets (where they didn’t have a channel) and eventually win in enterprise markets as internal IT shops increasingly emulated CSPs.

Grow Fast or Get Acquired

Scott got the team focused on this mission and reminded them that these were the roots of 3PAR. Scott reminded them that they’d beaten adversity before and raised $100M to launch 3PAR during the dot com blowup. Since inception they’d been focused like a laser on the utility model. He pulled out two documents, an early 3PAR business plan and the Red Herring prospectus prior to 3PAR’s IPO. Scott reminded the team that the company’s strategy had always been to provide so-called utility storage. At the time of the company’s launch, storage service providers (SSPs) were the hot market space but that market tanked, forcing 3PAR to sell to other industry segments (e.g. financial services). The market was now moving back in 3PAR’s direction under a new name — cloud services — and 3PAR was perfectly positioned to capitalize.

3PAR’s growth strategy, Scott said, was to parlay its lead in simplicity and efficiency and go hard after cloud infrastructure players. This was the fastest growing segment of 3PAR’s business, and the company was clearly gaining traction in the space. If it stuck to its knitting, it would eventually catch lightning in a bottle.

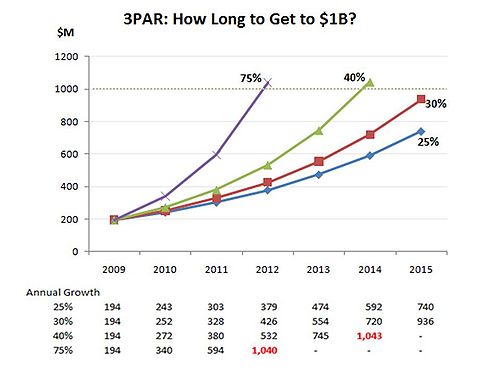

Scott turned to the CFO and asked him to put forth some growth scenarios. When, asked Scott, can we hit $1B in revenue? We are growing fast but can we grow faster? The CFO put up this chart showing 3PAR’s revenues from 2009 (actual) and its projections for 2010 and beyond. He showed four average annual growth scenarios over time of 25% (the Wall Street consensus at the time); 30%, 40% and 75%.

The data suggested that at its current growth rate it would take 3PAR more than five years to hit its target. The concern was that by then the market would have passed the company by, and it would have great difficulty maintaining its leadership position. Even if 3PAR could take its current 2-year growth rate from 25% to 40% it wouldn’t hit $1B until 2014. Scott didn’t see this as a viable scenario to take back to the board. He said 3PAR needed to get there within 24 months – how do they do it?

The problem the 3PAR management team realized was that while the company’s products were excellent and its strategy was right on, it didn’t have the sales bandwidth, brand recognition or market power to suddenly call forth a 75% growth scenario. There were no knobs that management could turn without diluting shareholder value considerably in the short term. While cloud was hot, way back in 2010, it still hadn’t achieved the level of dominance it enjoys today in 2015. Cloud simply wasn’t big enough and 3PAR either needed more time or a bigger partner.

Get Acquired

The team started looking at acquisition scenarios. There were two obvious candidates; HP and Dell. HP was a mess. It just lost its CEO to a bizarre scandal, and the company was in the midst of swallowing the Ethernet networking company 3Com and several smaller storage players. It wasn’t in a position to make a move.

Dell on the other hand had acquired EqualLogic, an iSCSI SAN player in 2008. Dell transformed EqualLogic from a small company, roughly 3PAR’s size, into a huge success that was on track to hit $1B in revenue — 3PAR’s magic number — in the near term. Dell was undergoing a transformation from a PC maker that resold assembled components to an enterprise IT leader. In addition to EqualLogic, it had recently acquired Perot Systems, a leading services company, along with Exanet, a near-defunct NAS player, and Ocarina, a leader in compression and deduplication for primary storage. Dell lacked a high-end storage play, and 3Par made a lot of sense.

Unbeknownst to the 3PAR team, David Scott had taken several meetings with senior Dell executives and had determined that there was genuine interest in acquiring 3PAR. Under the strictest confidence, Scott informed his team about the discussions, and they huddled on valuations.

The team all agreed that if 3PAR could double its valuation overnight, it would be a great exit for the company.

Dell – the New Storage Powerhouse

On August 17, 2010, Dell announced an agreement to acquire 3PAR for $1.15B. History in the storage business was to be re-written. Contrary to the opinion of many analysts, Dell wasn't going to focus its energies on trying to integrate 3PAR, EqualLogic, Ocarina, and Exanet. It rather would do some lightweight integration and focus more on selling and growing its market share.

It was a great plan until HP swooped in and offered to pay 3PAR nearly $1.6B for the company. At bidding war ensued and HP, the much larger firm ended up with 3PAR. Rather than run it as a separate organization, HP integrated 3PAR into its business and while the company's technology lives to this day, it's very difficult to determine where the historic 3PAR lines are drawn. The company has been mashed and converged and commoditized with networking and server products. HP is still huge and it would appear 3PAR is part of that hugeness.

The Future History

DISCLAIMER: A future history is a theoretical history of the future and is often used by authors to speculate and construct fictitious scenarios. It was used by Dave Hitz, co-founder of NetApp to help guide the company through its early and formative years and is often employed as a planning tool by executives. While much of the content in this article is true, some of the information contained here is complete fiction. Every attempt was made to present quantitative data as accurately as possible.

Action Item:

Footnotes: