According to newly released data from IDC, overall worldwide revenue for servers decreased by 4% in Q3 2012. Over the last decade, as server virtualization adoption has increased, we have seen a steady decline in the revenue and number of servers. Some bright spots of growth for server revenue are in the blade server and hyper-scale or "density optimized" servers. As discussed in Wikibon's Software-led Infrastructure manifesto, converged infrastructure (which typically uses blade servers) and low-powered servers (which the density optimized servers are driving towards) are the disruptive technologies for the compute layer of infrastructure.

Blade Server Rundown

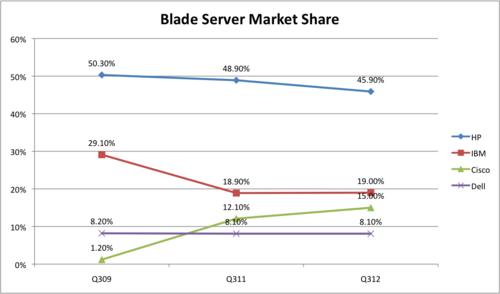

IDC's numbers for the segment as a whole was: 2.9% year-over-year revenue growth, 1.1% unit decline, and 91% of all blades are x86-based.

- Cisco's UCS has continued to gain market share from the incumbents. While UCS still has not achieved the typical John Chambers goal of being #1 or #2 in the market, the product line is still central to Cisco's data center strategy.

- HP still holds a strong #1 position in the blade server market (and #1 in overall x86 market revenue).

- After several years of a declining position in blade servers, IBM (which still holds the #1 overall server revenue lead) had a positive growth year for blade servers and is looking to leverage its PureSystems solutions to move beyond blade servers into the convergence marketplace.

- Dell's position in blade servers is unchanged. Dell is the leader in the aforementioned hyper-scale category.

HyperScale Computing

Cloud and Big Data are the target use-cases for Hyper-Scale compute solutions. The cloud solutions typically target Web-based companies or service providers where the power and cooling of thousands of servers can outweigh many other criteria (Dell PowerEdge C Series as the leading example). The big data offerings are typically a tightly coupled solution of compute with local storage (such as HP's SL family).