When Oracle announced the Sun technologies-based Exadata in 2010, it claimed to have a backlog of $1 billion. Since then we have seen a steady retreat in optimism about Sun sales in general (including Exadata and Exalogic products) illustrated by a 14% drop in Sun sales in the last quarter.

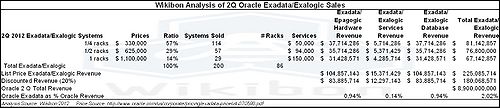

Recent Oracle statements have combined Exadata and Exalogic sales together. Oracle stated that it sold 200 Exadata/Exalogic systems in 2Q 2012 and approximately 1,000 since these systems were introduced. Based on the assumptions that Oracle sold twice as many half-rack system as full racks, and twice as many quarter rack systems as half-rack systems, and taking the prices from Oracle as of March 2012, Wikibon projects that Exadata/Exalogic hardware revenues in 2Q 2012 were about $84m, or about 1% of Oracle revenue. Including services and software, this means that Exadata/Exalogic sales account for approximately 2% of total Oracle revenue.

Source: Wikibon 2012

Prices from Oracle, downloaded 5/20/2012

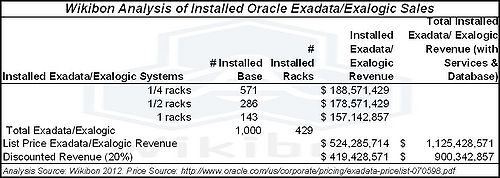

Table 2 shows that the installed hardware sales to date are about $400m, and if service and software are included, about $900m.

Source: Wikibon 2012

Prices from Oracle, downloaded 5/20/2012

This analysis suggests a significant erosion of the original $1B Exadata-only backlog.

Action Item: This analysis together with the Wikibon comparison of Exadata costs with other solutions indicates the market for hardware sales driven only by development is limited. If Exadata or Exalogic is the correct solution for your organization, the data shows the potential for discounts in the 50-70% range, in return for the honor of being tied in to Oracle. Other converged infrastructure solutions for Oracle databases, such as VCE, should be investigated and a full cost analysis performed.

Footnotes: