Contents |

Executive Summary

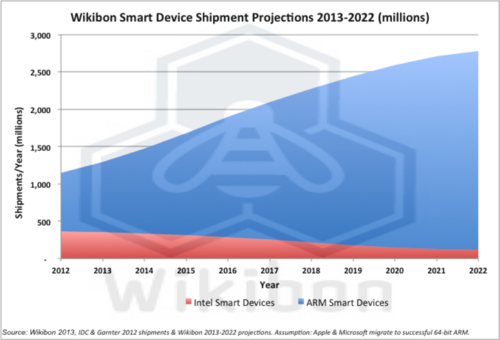

Intel's fourth quarter 2012 revenues were down 3% at $13.5 billion and profits are down 27% overall. PC revenues were down 6%, losing out to increasing consumer demand for smart phones and tablets. Figure 1 shows there were about 370 million shipments in 2012 for x86 PCs, including laptops, ultra-books, desk-top PCs and a small number of tablets. In contrast there were more than 780 million post-PC devices, including smartphones & tablets shipped in 2012.

The key strategic questions are:

- Is this a short-term decrease in PC chip revenues, caused by the recession and lengthening PC refresh cycles, or are other more profound market changes appearing that will radically alter Intel-based PC volumes?

- What are the strategic ramifications if or when traditional PCs are no longer the default client technology to be supported by data center infrastructure?

- If ARM processors and technology becomes dominant in the smart client device and PC market, will history repeat itself with the emergence of these chips in data center servers?

This research will cover the first two questions. A companion piece will cover the potential changes to server technologies, and the role that hyperscale will have in Software-led Infrastructure (SLI).

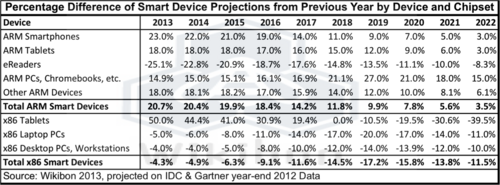

The conclusions of this research are that technologies from ARM holdings will most likely grow from 68% of shipments in 2012 to 85% in 2016 to 96% in 2022; this is shown in Figure 1, with greater detail in Figures 2 & 3, and Table 2. The key assumptions are:

- Licensees of ARM technologies successfully introduce 64-bit Cortex A53 & A57 in early 2014;

- Apple announces migration of PCs from Intel to ARM by early 2015;

- Microsoft announces migration of PCs from Intel to ARM by early 2017.

Microsoft is likely to respond (eventually) by disaggregating the divisions, abandoning PC & tablet development, treating client operating system software as a cash cow, allowing Office and other software to run on any platform, and focusing the company more on the highly successful data center software business.

Intel is also likely to respond by shifting attention to ensuring that the low-end of the enterprise server market and the hyperscale server market are covered with aggressive pricing and enhanced functionality.

CIOs, CTOs and senior executives should view the volumes and assume for planning and strategy purposes that there will be a constant migration from Intel clients to ARM-based clients. Key strategies include:

- Managing BYOD to reduce costs and improve user productivity;

- Greatly improving authentication and security services;

- Implementing strategies where all user data is reflected continuously back into data center cloud servers;

- Accelerating use of VDI services for large groups of desktop deployments and for allowing access to legacy x86 client applications.

Smart Client Volumes, IP & Developers

The four keys to success in chip manufacturing are:

- Volume,

- Intellectual property (IP),

- Software development ecosystem,

- Access to capital.

Chip Volumes

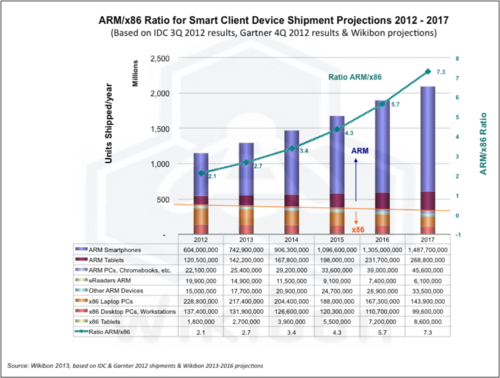

The post-PC clients are primarily using 32-bit ARM chip technology, not Intel. These processors have much lower power requirements, and are part of a very strong ecosystem with companies such as Broadcom, Nvidia, etc. Intel now has to be significantly lower cost and better functionality to be considered in this space and is struggling for volume, and IP that differentiates. At the moment ARM client device shipments are 2.2 times those of Intel X86 devices, as shown in Figure 2. Greater volume and market share is key in the consumer chip marketplace, directly leading to higher margins.

Figure 2 shows the total of X86 64-bit smart client device shipments are projected to decline by aggregate 9% per year to about 250 million in 2017. In contrast, shipments of devices powered by ARM 32-bit chipsets are projected to grow at 22% CGR to about 1.8 billion shipments by 2017, shipping a ratio of 7.3 times as many ARM devices as X86 devices. The ratio in 2012 is 2.1. This ratio gives an overwhelming cost advantage from the volume.

Intellectual Property

Intel x86 chips and SOCs (System on a Chip) bring in 2-3 times more revenue per chip compared with ARM systems. The x86 chips are 64-bit and have higher functionality than the 32-bit ARM chips. However, to date Intel has been unable to bring the combination of performance and low-cost to the low-end of the device market.

Intel has a significant IP in chip manufacturing, particularly at the high end. Intel has developed new 3D TriGate technology, which it is applying to 22 nanometer production processes to shrink the size of the circuitry and improve SOC performance and power consumption. However, delivery of this technology has been delayed to late 2013, and the power consumption differences compared to other technologies are not compelling.

The biggest threat to Intel was announcement in October 2011 of ARM Holdings v8 architecture, which include 64-bit support. In October 2012, ARM announced the Cortex-A53 and A57 64-bit processors. ARM Holdings is expected to deliver all open-source support and a licensable core design in 2013, with volume shipments in 2014. Several ARM licensees, including AMD, Applied Micro, Cavium Networks, Nvidia, Qualcomm and Samsung, have the ability to develop their own core designs and ship in 2013.

Source: ARM Holdings, downloaded from [1] January 20 2013

The Cortex A50 series has to meet several important challenges:

- Prove the power efficiency envelope;

- Prove practical upward software compatibility from earlier ARMv7 architectures;

- Prove the core design can be manufactured efficiently and in volume and retain the previous cost advantage over Intel;

- Prove that a market for 64-bit ARM products exists in cell-phone, tablets, and PCs;

- Prove that performance in excess of 2GHz can be achieved in 2013.

If these challenges are met (and there is clear market expectation that they will), ARM will have established a road map that will enable the vast majority of smart mobile devices to be powered by ARM chipsets. If this happens, Apple (Wikibon estimate in late 2015) and Microsoft (Wikibon estimate in early 2017) will both announce migration of their low-end PC platform to ARM, leaving the Intel PCs to compete in the high-end specialty markets until the ARM technology eventually subsumes them.

Figure 4 below looks at the Wikibon projection 2013-2022, assuming that Apple and Microsoft migrate their PC software to 64-bit ARM.

Software Development Ecosystem

Intel is highly dependent on Microsoft Windows, and to a lesser extent Apple, as a software supplier for PCs. Windows 8 Pro is a good product for high-end knowledge workers and introduces touch. This will allow Windows 8 Pro tablets with Intel e5 and e7 chips, again at the high-end of the market. However, the Intel chips are expensive (~$200). Windows OS and application software are expensive (>>$100’s), and it is difficult or impossible to transfer software licenses from one machine to another. The tablets are more powerful, but heavier, and have half the battery life of ARM tablets. That means users need to carry charging equipment and find electrical outlets, increasing weight and inconvenience.

The PC software business model is different from the volume mobile phone and tablet market. The software is not easy to use for entry-level users, and its philosophy of expensive new versions rather than continuous improvement is not in line with other tablet and smartphone software. Microsoft is showing some success in growing market share in smartphones with its partnership with Nokia. However, that does not help Intel, as the chips for almost all phones are ARM based, and the developer community and ecosystem has followed volume.

The areas where the PC has any unique advantage over large phones and tablets are shrinking rapidly, as the massive mobile developer network and ecosystem has moved over almost exclusively to work on ARM-based systems. Apart from Microsoft and to some extent Apple, very little new application development is happening on X86 clients. PCs are rapidly becoming the mainframe of smart devices and clients, focusing on high-end gaming machines, video editing, and other high performance areas. Hundreds of millions of Microsoft users have grown up with the software and are very loyal to the platform and applications. The same is true of the mainframe, and like it the PC will remain an important but declining niche for high-end performance and high-end client applications.

Windows 8 RT is a 32-bit based derivative of Microsoft’s mobile OS and is not compatible with Windows 8 Pro; watch a Microsoft store sitting next to an Apple store, and you observe the Microsoft Surface RT tablets is getting almost no traction. Samsung recently announced it was not producing tablets for Windows 8 RT, and Dell has a single RT machine in a sea of Windows Pro tablets and PCs.

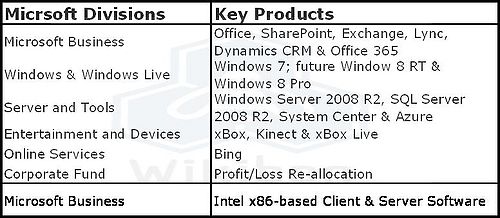

Microsoft Positioning

Microsoft is a strong software development company with five main divisions (see Table 1). It will need to position itself for a migration of the device operating system and software from Intel chips to an ARM ecosystem. Although the migration of smart client devices from Intel to ARM will affect the revenue and profitability of the Microsoft Windows and Windows Live division, the Server & Tools together with Microsoft Business are and should remain very strong. Microsoft would be expected to disaggregate the divisions in the future, and in particular allow business software to run on multiple platforms.

Intel Positioning

Intel is also likely to respond by shifting attention to ensure that the low end of the enterprise server and the hyperscale server markets are covered with aggressive pricing and enhanced functionality.

ARM 64 bit processors are very likely to ship late 2013 or in early 2014 at 2GHz and higher, which makes them viable servers. Intel initially grew its current server base by using its commodity chips to drive volume and replace RISC processors from IBM, HP, SGI, and Sun. Intel grew its server business for 10 years by transitioning from only winning the lower performance boxes to having chips embedded throughout the entire data center. The same market forces are here again, this time working against Intel.

Hyperscale is the term to define the server requirements of very large data centers with relatively few applications, such as those supporting Internet companies such as Google, Facebook, and Apple. Open Source commodity servers with high volumes but with "no frills", and initiatives such as Facebook's Open Compute Project (OCP) mean that Intel needs to work very hard not to loose the lower end, where ARM processors have a 3:1 volume advantage, and potentially a 5:1 electrical power advantage. This will allow smaller servers to be packed closer together at lower cost. Although the slower speed will not be suitable for all workloads (e.g., latency sensitive database applications), there are many suitable workloads for low power2 servers. Currently, Intel owns the data center ecosystem.

Intel is unlikely to retain a significant share in the post-PC phone and tablet market - that horse has bolted. Intel will have to ensure that it keeps the eye on the ball in the lower end of the server market. That means aggressive pricing and lower profits. It needs to focus on innovation that will differentiate servers from clients and dampen the volume advantages that ARM processors will have. Intel may retain revenues, but it is very unlikely to retain the historic levels of profitability.

Action Item: CIOs, CTOs, and senior executives should track the volumes of smart client devices being shipped. For planning and strategy purposes they should assume a constant migration from Intel to ARM-based clients over the next 10 years. Key strategies to reduce the cost of purchasing and supporting the include:

- Managing BYOD to reduce costs and improve user productivity;

- Greatly improving authentication and security services;

- Implementing strategies where all user data is reflected continuously back into data center cloud servers;

- Accelerating use of VDI services for large groups of desk-top deployments, and for allowing access to legacy x86 client applications.

Footnotes: Table 1 shows the percentage change in shipments from the previous year, by device type and chipset type. The data assumes that the 64-bit ARM technology is successfully introduced, and that Apple and eventually Microsoft transition their PCs to this platform. The data forecasts, especially in the outer years,