With Nick Allen

Summary

Tested and validated configurations are an important first step to providing base level infrastructure and accelerating adoption of virtual data center technologies. Nonetheless, the VMware-Cisco-EMC coalition is table stakes in the journey to the private cloud. The virtual compute environment (VCE) has much more to prove in the areas of performance, automation, availability, recovery and scalability before it can meet VMware’s ambitious goal of running any application and any workload.

This is the second in a series of research notes on VCE. Part 1: Eleven Questions about Virtual Compute Environment (VCE).

EMC in the Driver Seat

EMC’s 2003 acquisition of VMware for $635M has not only yielded a $15B+ market cap return for shareholders, it has also placed EMC at the epicenter of the battle for data center dominance—an amazing feat for a storage company. EMC’s leverage with VMware allows it to heavily influence this coalition if not call many of the shots.

The VCE partnership is clearly aimed at accelerating the revenue streams of VCE. While VCE claims the initiative is open, what it really means is it’s not closed—an important nuance. Specifically, VCE is a coalition designed to confer advantage to its direct participants and their customers—if you’re not invited to the party, you’re at a disadvantage. Translation—the VMware deck is stacked in VCE’s favor.

There are two major industry implications of this fact specifically and this coalition in general if it succeeds; namely:

- The winners are VMware, Cisco, and EMC along with Intel and the six announced integrators. Furthermore, this coalition has great appeal to loyal EMC customers that are happy to build homogeneous EMC infrastructure and exist as predominantly EMC shops.

- The losers are IBM, HP, Dell, BMC, Microsoft, Sun/Oracle, NetApp, Hitach, and every other storage player. One result is these non-Acadians are going to be much friendlier to Microsoft and Citrix.

The leading competitors will create reference architectures for VMware. Here’s an example with Brocade and Oracle. Will they be as fast to market and as complete as VCE? Probably not, but Wikibon members with existing vendor relationships outside of the VCE ecosystem won’t lose much by waiting for IBM and HP to catch up.

One additional side note is that while storage networking connectivity is unclear, it is likely that FCoE will figure prominently into the mix going forward. QLogic is leading the FCoE design race with converged network adapters (CNAs), and we believe it will be the primary supplier to VCE. QLogic has announced a relationship with EMC, and at several trade shows Wikibon has attended Cisco has displayed its UCS with QLogic CNAs exclusively, leading us to believe that QLogic will benefit both financially and strategically from this initiative.

The VCE To-do List

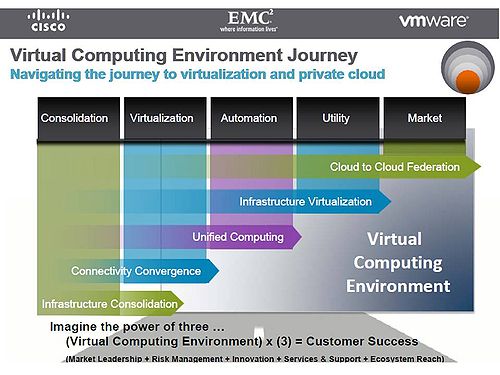

VCE marketing underscores the journey customers will take toward the private cloud. There are five steps as shown in Figure 1.

While this journey is marketed as seamless, VMware customers in the Wikibon community complain of several adoption barriers, including:

- Performance problems require an army of PhD’s and a dozen tools to remediate.

- Backup in VMware is challenging and taxing existing processes.

- Administrative efforts around these challenges bring hidden costs that need to be carefully evaluated.

- Containerizing applications more aggressively is being limited by lack of visibility of performance and backup challenges.

- As a result, many VMware licenses are going unused.

- No Wikibon members have indicated that they’re successfully containerizing mission-critical Oracle database-based applications.

These action gaps are in a way good news for the VMware ecosystem, as there’s much work to be done. However, for most users the prospects of moving legacy applications to VMware are remote in the near-term.

Action Item: VCE takes the covers off a major effort by VMware, Cisco, and EMC to bring world-class integration and testing capabilities to VMware environments. For customers, as constituted today, VCE doesn’t radically change the challenges facing VMware adoption and users must carefully evaluate how hard they can push VMware into legacy applications. The risks of doing so include hidden administrative costs associated with diagnosing performance problems, ensuring high availability and architecting rapid recovery.

Footnotes: