In early May 2009, IBM Global Financing (IGF), IBM's lending and leasing business unit, launched an imaginative program to help kick-start IT infrastructure projects. The initiative made available up to $2B for financing technology projects in the US. On May 27th, IBM extended the program to a total of $5B, adding another $3B earmarked for 25 countries in Europe and Asia. IBM also expanded coverage for the original $2B to include Canada.

IBM has two potential groups in mind who are both strapped for capital.

The first group is comprised of entities who are applying for the American Recovery and Reinvestment Act (ARRA) funds, with an initial focus on health information technology, smart grid solutions and other selected initiatives (e.g. energy efficiency). Much of the government's funding will not be available until 2010 and beyond. As such, capital funds are very tight for enterprises and municipalities that want to start projects now but won't receive stimulus funds perhaps for years. As announced in its initial domestic program, IBM is making $2 billion available to provide interim financing for IT infrastructure expenditures related to ARRA projects. By matching the repayment schedule to the expected stimulus funding schedule, IBM is expecting to benefit three constituents:

- The client organization that will be able to start the project and receive the funds;

- The economy of the United States and the world by the earlier injection of economic activity;

- IBM itself by the quicker sale and implementation of hardware, software, and services.

The second group are CFOs and CIOs strapped for capital funds and facing severe competition for tight funds across their organizations. CIOs are finding that any projects requiring capital that do not break even within the financial year are being shelved indefinitely. To help kick-start these projects and accelerate its own sales, IBM Global Financing has announced innovative finance programs that fit financing repayment schedules to the cost benefit stream of projects, with the goal of providing an immediate or very fast break-even.

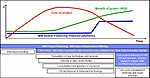

In essence, IBM is turning large upfront costs into deferred monthly payments. Figure 1 illustrates how a range of IBM planning, consultancy services and products (in white boxes) together with a package of financial offerings covering the acquisition and disposal of technologies and services (blue boxes) can deliver a complex project with perpetually positive or near positive cash flow. In addition, IBM Global Asset Recovery Services (GARS) operates a state of the art reverse logistics business where IGF can provide asset disposal services as part of the fund flow management. The value extracted from these surplus assets can be allocated as additional funds toward the implementation costs. IBM emphasizes that disposal of equipment is in compliance with applicable e-waste and data privacy regulations.

Other key benefits of this approach for IT organizations and their end-users include the replacement of older generations of equipment with faster, more energy efficient servers, storage or other equipment while potentially lowering costs and risks, improving services and taking advantage of technology advancements thereby accelerating time-to-value. This approach is marketed by IBM as 'Dynamic Infrastructure.'

With $36 billion in total assets and 125,000 clients, IBM is seen as the 'Gold Standard' of technology financing. This initiative sets IBM apart in a contracting field where credit is generally tightening. However, there are risks in late balloon payments stream which must be understood and managed.

Action Item: This approach to funding projects carries risks that the proposed IT project benefits will not materialize when the large deferred payments are due. The CFO, CIO, and the lines-of-business will need to insure that realistic and conservative estimates of cost reduction are being made and that aggressive project management is in place to accelerate the realization of benefits. IBM can provide tremendous simplicity to IT infrastructure projects by bundling equipment, servicing, and financing. It is essential that for large projects appropriate risk management review is applied either from within the organization or from outside consultants.

Footnotes: