And Why Microsoft Wants You To Deploy DAS for Exchange

Read Part II of this series: Should Exchange 2010 use DAS or SAN

Read the blog post: Why Microsoft's Head is up its DAS

Contents |

Research Premise

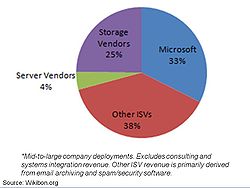

Microsoft is reacting to increased pressure from Google generally and Google Apps in particular. Microsoft has a lot to lose. Google’s enterprise Gmail offering is gaining momentum and especially threatens Microsoft’s on-premise Exchange revenue base in the near term. As shown in Figure 1, our research indicates that Microsoft currently captures approximately one-third of the total Exchange revenue opportunity in mid-to-large customer sites. We believe the company is intent on protecting this base by bundling more function into its own software stack and stealing value from other segments of the pie—a common tactic in the Microsoft playbook.

The competitive threat from Google is forcing Microsoft to initiate two strategies designed to protect its on-premise Exchange revenue base and compete more directly with Google’s cloud offerings:

- Lower the cost of on-premise Exchange deployments without impacting its own revenue;

- Initiate more aggressive pricing of its Microsoft Exchange Online SaaS offering.

The threat from Google is having ripple effects on storage architectural decisions as Microsoft is aggressively recommending direct attached storage (DAS) for Exchange environments. Because Microsoft is loathe to give up its lucrative software revenue, its on-premise Exchange strategy is to bundle more storage and archiving function into its own software stack and recommend DAS as a way to simplify infrastructure and reduce the perceived cost of Exchange deployments, while keeping its software costs high.

Organizations need to understand the motivation behind Microsoft’s strategy and carefully consider storage alternatives for their specific environments before making important storage infrastructure decisions in Exchange environments. The reality is that while using DAS and Microsoft storage services for Exchange makes sense in many smaller use cases, it is often a more expensive and less functional strategy for larger shops. In a fully loaded analysis of cost, including staffing, power, and cooling, storage costs account for less than 20% of Exchange total cost of ownership (TCO). Therefore, foregoing SAN functionality for perceived DAS savings often may not achieve desired outcomes for many organizations.

The purpose of this Alert is to evaluate the competitive threats driving Microsoft’s Exchange strategy and establish fundamental economic guidelines for users to consider in Exchange deployments. This is the first in a two part series of research notes and will focus on the competitive threat Google poses to Microsoft. In this note we put forth an economic model for evaluating on-premise Exchange versus cloud-based email offerings from Microsoft and Google.

Part Two will present a return on asset (ROA) and total cost of ownership (TCO) model that will allow mid-to-large users to objectively evaluate the economics of SAN vs DAS in Exchange environments and understand the dependencies each has on cost and business value.

Background: Competitive Cycles in the IT Business

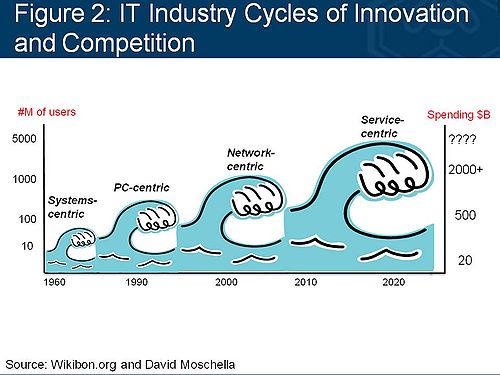

The history of the information technology industry can be described using a metaphor of waves that coincide with major technology cycles. Figure 2 depicts the four great eras of computing: Systems-centric (dominated by the mainframe), PC-centric, network-centric and now service-centric, specifically Web services.

The chart has three key points:

- Each wave is successively bigger than the previous one—more users, more spending and generally more risk.

- Old companies go away and new companies are ushered in with each new wave. The BUNCH, Compaq and now Sun Microsystems have all basically disappeared as IT vendors.

- The names listed for each wave could be replaced by company names that were leaders of their respective eras, namely IBM, Microsoft (and Intel), Cisco and now Google.

Google’s massive investments in file systems, databases, analytics, applications, Web services, and global data centers are driving the next wave of computing. Moreover, its advertising business model makes it a threat to virtually every company in the industry including hardware, software, services, and mobile telecommunications firms.

No company has more to lose in this transition than Microsoft.

Enter Google Apps for the Enterprise

One of Google’s most threatening offerings for Microsoft, and the most interesting for IT managers, is Google Apps. Google has some quality references that use the service including Genentech, the biotech company in Boston, and the City of Los Angeles.

According to Todd Pierce, Vice President of Information Technology at Genentech, the appeal of Google Apps is that the solution is online, integrated, always on, simple and doesn’t require training. It’s also device-independent, meaning email and apps can be accessed anywhere, anytime (assuming a Web connection). And it scales from a single user to tens of thousands, literally on demand.

Google claims that more than two million businesses use Google Apps, and the company offers migration tools to help customers move from Microsoft Exchange and other email environments. As indicated, Microsoft’s response has been to aggressively recommend DAS as a means to lower the perceived CAPEX of Exchange deployments and improve its Exchange Online offering.

Cost Analysis: On-premise versus Cloud-based Email

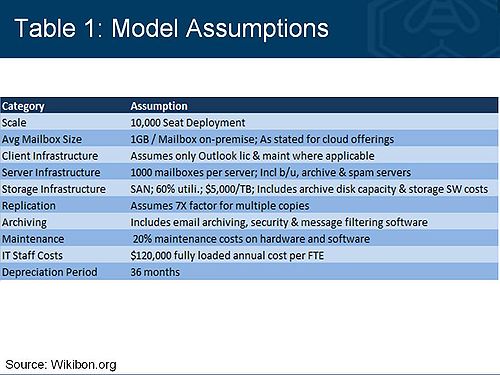

To better understand the cost drivers, Wikibon performed an economic analysis comparing an on-premise Microsoft Exchange deployment with Microsoft’s Exchange Online and Google Apps Premier Edition. Table 1 highlights some of the key assumptions used in the model.

Note: Wikibon conducted in-depth surveys with approximately 15 CIO’s, Application Heads and Infrastructure Architects to support this research.

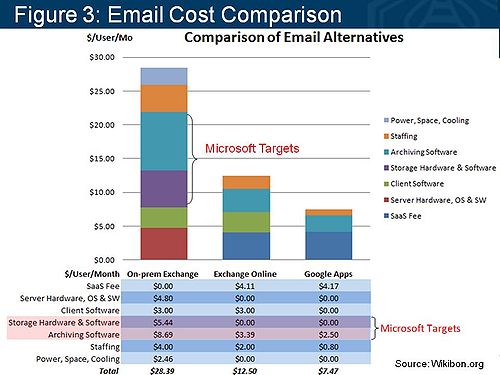

Figure 3 displays key components of the cost model we developed for this analysis. We used a 10,000 seat on-premise Exchange installation as the base point of comparison and believe this model to be representative for a wide range of user scenarios at mid-to-large companies. Individual costs will vary by user count, however. The following additional points are noteworthy:

- Microsoft’s Exchange Online monthly subscription fee is actually lower than Google Apps. However Microsoft’s client/server model increases costs for client software, maintenance, and on-site staffing.

- As a result, Exchange Online’s TCO is approximately 1.6X higher than that of Google’s.

- On-premise Exchange is nearly 4X the TCO of Google Apps.

- The clear targets for Microsoft to lower the perceived costs of on-premise Exchange are the storage and archiving layers of the Exchange value stack.

- Analysis of 10,000 seat deployments. Function and pricing vary between on-premise and cloud offerings. Cloud archiving and spam filtering software: Microsoft- Exchange Hosted Archive; Google- Postini.

- Google Apps costs are $50/user/year for 25GB of email storage. Google’s archiving/spam filtering service costs (Google Message Discovery/Postini) are $45/user/year ($30 for volume customers) and include unlimited storage for ten years.

- For archiving, Google provides RAID-protected disk storage located in two geographically distinct locations. Google claims to index message data and then write it to two separate locations for long-term storage.

This analysis underscores why Microsoft’s Exchange group is motivated to try to attack the two biggest culprits of on-premise costs, storage and archiving. Microsoft’s strategy has consistently been to develop ‘good enough’ solutions for smaller customers, bundle more function into its software stack, and maintain its pricing umbrella.

Microsoft’s recommended storage strategy calls for DAS, which will presumably help lower Exchange TCO. However as we explore in Part Two of this series, larger customers must consider the bigger picture and evaluate costs, availability, and business value across the entire application portfolio. Considering Exchange in isolation can often increase costs and pose unnecessary information risks to organizations.

The Dark Side of the Cloud

Despite the economic attractiveness of Cloud-based email, customers need to carefully evaluate several factors for their individual situations. Specifically:

- SLA’s: Both Google and Microsoft SLA’s for Cloud apps leave lots of wiggle room for the vendor. Some examples from Google’s SLA include the offer of three 9’s availability (i.e. more than 8 hours of unplanned downtime per year) and outage definitions based on ‘server error rates.’ Google has had some high profile outages, and these parameters may not be adequate for many large and mid-sized organizations. To its credit, Google has responded with a Google Apps Status Dashboard that provides visibility on outages.

- Privacy and Security: These are the two most common obstacles cited by IT management when considering Cloud apps. Google’s privacy statements include attempts to address customer concerns, but the fact remains that Google is becoming the gatekeeper of the Internet and is mining user data to drive advertising revenue. While Google Apps data may not necessarily be directly linked with individuals, where and how data is stored is unclear. Google has had privacy breaches in the past and customers should understand the risks and push Google for contractual penalties in the event of a breach.

NB - Since this original posting, we've discovered an interesting security and privacy trade-off when comparing the use of Microsoft email and Google apps for collaboration and information sharing use cases. To be specific, some users view the use of Google apps for document collaboration and sharing among business units to be more secure and less risky than the use of email for the same purpose. The theory is that when used with a strong identity and access management practice, Google apps is better at keeping track of who has access to information, how the information is used, and where all copies of a document, spreadsheet, etc. are located.

- Legal Agreement: Google App’s Terms of Service (TOS) agreement includes language that is often favorable for Google and should cause concern for customers. For example, Google is required to make “commercially reasonable” efforts for certain commitments whereas customers are sometimes required to make “best efforts.” In legal terms, different standards are applied to these phrases with “best efforts” being more onerous.

- Functionality: Cloud apps require tradeoffs in several areas. Users must generally be connected to the Internet to access services or architect workarounds to allow un-tethered workers to access data. Also, how backup is accomplished is unclear, and users should carefully consider not only backup but recovery.

- Legal Compliance and Discovery: In speaking with records managers, Wikibon believes that Google Apps’ archiving is more of a data repository than an archive. Customers should question Google about accessibility to older content, the commingling of data with that of others, what happens in the event of an eDiscovery request or a legal hold, and how an ESI data map can be defined.

Despite these deficiencies, IT cannot drop its guard and ignore the ensuing Cloud email onslaught. If anything, these terms and conditions are becoming the rule, not the exception. It is more likely that these realities point to an unstoppable scenario unfolding that conditions users to trade less stringent terms for simplicity, transparency, choice and scalability.

Conclusions

Microsoft is caught between a rock and a hard place. It is being forced to compete with Google’s Cloud-based services, which dramatically lower costs for users relative to on-premise Exchange deployments. However, Microsoft’s cloud offering includes Microsoft client-side software in an attempt to preserve revenue, making its services more complex and costly relative to Google Apps.

At the same time, Microsoft is aggressively trying to reduce the perceived costs of on-premise Exchange and in doing so is forcefully recommending DAS to clients. Its strategy is to incorporate more storage functionality (e.g. replication) into its own software stack and capture value from storage and archiving solutions which comprise a large portion of Exchange spending.

As we will explore in Part Two of this series, Microsoft’s on-premise strategy will not be appropriate for all organizations. Specifically, its storage software and archiving functionality, while good enough for smaller shops, will often be deficient for more demanding customers. Also, the perception of lower cost through DAS is often illusory as true TCO analysis must include the degree to which infrastructure can be used across the application portfolio. Indeed, in many instances customers will find SAN to be less expensive than DAS from both a CAPEX and OPEX perspective. As always, customer mileage will vary. The resources listed in the footnotes used in constructing our analysis and may be useful for customers to perform their own economic and business value modeling.

Action Item: Pressure from Google Apps is forcing Microsoft's hand in both on-premise and Exchange Online deployments. Microsoft's advice to configure Exchange 2010 with DAS is largely designed to protect Microsoft's lucrative on-premise software revenue base by making on-premise deployments appear simple and less expensive. Before committing to any Exchange strategy, organizations should evaluate their long-term goals and consider email in the context of a wider application portfolio to understand the true cost of messaging infrastructure

Footnotes: Additional Resources: