Dell Financial Challenges

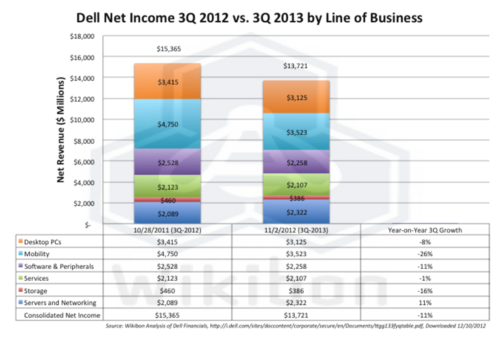

Dell's challenge is shown clearly in the data in Table 1, taken from the latest Dell financial statements. Figure 1 shows the comparison between 3Q 2012 and 3Q 2013:

- Server and networking equipment is growing well (11%) compared with the same quarter in 2012;

- Dell has had challenges replacing the EMC storage arrays it sold and integrating the EqualLogic and Compellent purchases into a coherent storage portfolio, and Dell storage sales have declined 16% compared with the same quarter in 2012;

- Dell Services have been flat;

- Dell Software & Peripherals have declined 11% compared with the same quarter in 2012, driven down by the reduction in PC and laptop sales;

- The largest line of business, Mobile & Laptops, has taken the worst hit with a 26% reduction compared with the same quarter in 2012;

- Desktop PCs has taken an 8% reduction compared with the same quarter in 2012.

Source: Wikibon 2012, based on Dell Financial Statements, Downloaded 12/10/2012

The total amount of revenue reduction from Mobility, Desktop PCs and Software & Peripherals is a large $1.8 Billion compared with the same quarter in 2011. The good news is that that Server & Storage grew by $0.16 Billion

Windows 8 to the rescue?

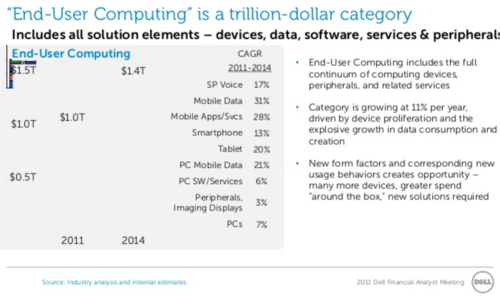

At the Dell 2011 analyst meeting, Jeff Clark presented the Dell 2011-2014 forecast for end-user devices, shown in Figure 2.

Source: Wikibon 2012, taken from [http:// http://www.slideshare.net/Dell/dell-2011-analyst-meeting-jeff-clarke-8455083#btnNext Dell Presentation to Financial Analysts 2011, Downloaded 12/10/2012]

At Dell World 2012 in December, Michael Dell and Jeff Clarke (Vice Chairman and President, Global Operations and End User Computing Solutions) still believe that:

- PCs are devices that do work, and tablets are for consumption;

- Windows 8 Pro and touch will capture a large share of the business market, and specifically the Windows 8 Pro tablets using Intel i5 chipsets that Dell has announced will be successful;

- An international market for PCs is growing as the middle class of emerging countries grows, and specifically there is only 20% penetration of PCs in 85% of the world, and therefore there is room to grow;

They made no mention of Windows 8 RT, and on the tablet stand a lone Dell Windows RT tablet was hidden at the side.

There is another, less rosy, vision of the Windows share of end-user device market, based on the data from Dell in Figure 1, HP, and Apple together with Wikibon research. If the following assumptions and assertions are valid, it would be reasonable to assume that the Windows share of the end-user device market could continue to decline as a percentage of the total end-user market:

- Apple claims to be taking 27% of the high performance mobile PCs at the high end, above $1,000, and will maintain or grow that share;

- At the low-end mobile devices such as ARM-based smartphones, large-screen smartphones, and tablets of different sizes are doing much of the work previously done by PCs;

- The functionality and amount of work that can be done on ARM-based devices is increasing rapidly and is directly competing with low-end PCs;

- The battery performance, hardware cost, and software costs of ARM-based devices is much lower than Windows 8 Pro PCs and tablets.

- A solid market remains for high-end desktop systems for enterprise work, high-performance workstations, and high-performance gaming systems (only 8% decline).

- Windows 8 Pro tablets and PCs will appeal to many of the current Windows knowledge workers;

- New and non-power users in all countries will find that Windows 8 Pro PCs need a mouse or stylus to supplement touch;

- The Windows 8 Pro devices are too expensive in software and hardware and have limited battery life compared with ARM-based systems for the vast majority of end-users.

Dell has only one product supporting Windows 8 RT. This is a low cost way of getting the full Microsoft Office Suite but will not support other Windows applications without a conversion. The Microsoft Surface RT tablet seems to be going in the same direction as the BlackBerry PlayBook.

Michael Dell and Jeff Clarke did not commit to when or even if a PC turnaround would happen.

Dell’s Software-led Infrastructure Bet

Michael Dell and Michael Haas (President, Enterprise Solutions) presented the strategic move away from depending on just components and units to focusing on providing services and solutions to improve the cost and manageability of enterprise data centers.

Wikibon has extensively researched the trends within the data center and strongly believes that the next wave of innovation within the data center will be to move away from software functionality being locked in a specific component (e.g., a storage array, a networking switch), to software being available as services across the data center (e.g., provisioning of storage, de-duplication of storage, etc.) These software components themselves communicate with components and with each other through open and de-facto standard APIs, The secret of the future is to provide an environment were it is win-win to work within the API framework, and create a non-zero sum game of overall efficiency and effectiveness.

Wikibon sees a number of disruptive technologies that will shape software-led infrastructure. These include:

- Flash-based persistent storage, with real-time metadata management;

- Importance: High

- Dell’s Position: Dell has a relationship with Fusion-io and has flash available as part of caching and tiering solutions. Dell will need to develop a flash-only storage array and software to integrate an environment where persistent data and metadata is spread across the datacenter and provide management between the active flash layer and inactive data stored on magnetic media

- Dell’s Score (1-10): 3

- Software-led Storage (SLS) will allow the migration to a topology where all storage services are provided at the system level and can be called and integrated into system-level storage management and system-level SLI management;

- Importance: High

- Dell’s position: Wikibon is not aware of any solutions or commitment to software from Dell, or any storage RESTful APIs that will allow Dell storage to be managed from other management software.

- Dell Score (1-10): 1

- Software Defined Networking (SDN), with virtualizion of the network and movement of network control into software, allows traffic to be prioritized and dynamically managed, guaranteeing predictable end-to-end application performance and latency;

- Importance: Medium

- Dell Position: Stu

- Dell Score: Stu

- New generation Converged Infrastructure using pre-tested building blocks based on open and/or consortia standards that work with other building blocks;

- Importance: Medium

- Dell’s position: Dell has integrated servers, storage and networking into the Active Infrastructure family. This includes blade servers, EquualLogic storage, a converged fabric, and an Active Systems manager. Work will be required to make metadata within the Active Infrastructure to be available via APIs to external system-wide management systems (Dell's as well as others).

- Dell’s Score (1-10): 5

- Low-cost Mobile Devices reflecting a world going mobile and social, the rapid increase in data access and creation from these devices, and the necessity to manage the security and availability of data across the network;

- Importance: High

- Dell's Position: Dell has announced a series of touch-enabled tablets and mobile PCs that are designed to take advantage of Window 8 Pro. The strong focus is on Windows 8 Pro - there is only one Windows 8 RT product and no Android products. However, although this may be a difficult hand to play as far as volumes and market share are concerned, the most important requirement for enterprise data centers is the ability to handle all varieties of end-user device, ensure management of devices, access to data, and sharing of data across private and public networks, and the ability to maintain security. Dell has developed good service and software capabilities to manage Bring Your Own Device (BYOD) strategies and overall end-user devices. Dell is stronger when it is integrating Windows end-user devices and Microsoft software infrastructure.

- Dell's Score (1-10): 6

- End-to-end Security allowing security to be defined within an application or system service;

- Importance: Medium (until there is a breach!)

- Dell's Position:

- Dell's Score (1-10): 8

- Management and Automation Software

- Importance: High

- Dell's Position:

- Dell's Score (1-10): 4

- Modular Datacenters with ultra-efficient use of power;

- Importance: Low

- Dell's Position: Dell do not offer pre-manufactured modular datacenter bricks, but have achieved good PUE values within the exisiting data centers

- Dell's Score (1-10): 3

- Low-Power Servers using ARM chips with lower costs driven by the volume of consumer end-user devices

- Importance: Low (for the moment)

- Dell's Position: Dell has research going on in this area, but no products in place. Waiting for 64Bit ARM.

- Dell's Score (1-10) 2

Dell's overall score is currently an overall 4

Action Item: Dell's transformation from a component high-volume manufacturer to a services and solution-led company focusing on the enterprise datacenter is an exciting journey. CIOs, particularly from small and mid-sized companies, should look hard at Dell's offerings, as the potential savings and business opportunities of moving to a Software-led Infrastructure are significant and potentially game-changing. They should also guide Dell to use and participate in developing open APIs that will allow a data center of many components from different suppliers to be optimized to meet the needs of the businesses that IT supports.

Footnotes: