The banking sector had a bang-up year in 2011. Total profit hit a five-year high of $119.5 billion. This year may not turn out to be quite so lucrative, but even JPMorgan Chase, with its recent high-profile $2 billion loss, is expected to report decent Q2 results.

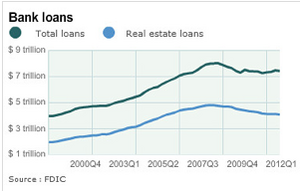

But lending has not kept pace. While lending rose modestly in 2011, overall lending among the top US-based banks is still down 7% from 2007. It is largely agreed among economists that a significant increase in lending to small businesses and consumers is needed to jumpstart an otherwise stagnant economy. And banks themselves, whose overall revenue declined last year for the first time since 1938, need to increase organic revenue growth as the benefits of 2009’s bailout fade into history.

The big banks say they are reluctant to increase lending due in part to the onerous regulatory environment. That may well be, but just as important, banks aren’t lending to SMBs, potential homeowners, and others because they don’t want a repeat of the 2008 economic meltdown and associated collapse of the housing market. As a result, current credit requirements make it difficult for all except those with the most pristine credit ratings to get loans at what are historically low interest rates.

The problem boils down to risk and the inadequate way banks determine the likelihood that a customer will default. Big Data offers a solution.

Currently, most banks determine the creditworthiness of an applicant based largely on his or her credit score, which itself is determined based on data collected by one or more of the four big US credit bureaus. While credit scores provide valuable insight on applicants’ payment and credit histories, the advent of Big Data unlocks a trove of additional social data that, when merged with credit scores and analyzed holistically, can provide banks more granular and accurate data on which to base loan decisions.

More to the point, such Big Data would, for the first time, provide an efficient and practical way for banks to make loan decisions based on highly personalized analytics at scale. The result would be a more accurate view of an applicant’s true credit risk and a resulting increase in loan activity, particularly to those applicants whose credit scores alone don’t tell the whole story.

Consider some examples:

- By enriching credit data with Facebook data, banks could uncover mitigating personal circumstances, such as a death in the family or severe illness, that account for a temporary dip in repayments.

- Career-related data from LinkedIn would allow banks to better predict the career trajectory, future earning power, and likelihood of unemployment for loan applicants in various fields of work.

- Tweets could be mined to identify applicants’ penchant for high-risk activities, such as cave diving or motorcycle racing.

- Likewise, geo-location data from social check-ins on mobile devices could make it possible for banks to predict an applicant’s risk of physical injury or death based on trips to dangerous locals.

These are just examples, of course, and innovative banks and other financial lending institutions that undertake Big Data projects will no doubt uncover many more valuable ways to take advantage of social data and analytics to better score risk. The benefits will be felt by the banks, loan applicants and, most importantly, a US economy that desperately needs a jumpstart.

Action Item: Banks and other financial institutions should identify the biggest risk-based obstacles holding them back from making more SMB and consumer loans, then brainstorm ways social media data and Big Data Analytics could help overcome them. When a solid business case has been established, begin exploring, in conjunction with bank IT departments, various Big Data approaches and tools, then execute on a targeted basis. With one success in hand, continue looking for new and innovative ways to leverage and re-use investments in Big Data Analytics.

Footnotes: Thanks to Tresata Founder and President Abhi Mehta for his input on this topic. Watch Mehta at Hadoop Summit speak about the opportunity Big Data presents to banks and others here.

For a list of Wikibon clients, click here.