Contributing authors: David Floyer, Jeff Kelly, Dave Vellante, Stu Miniman

Introduction to Overall Big Data Market by Vendor

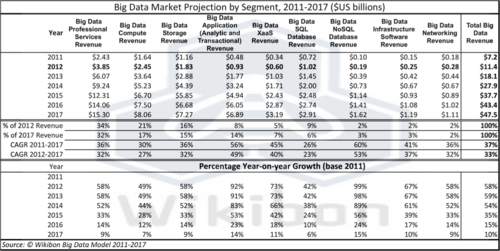

Wikibon's latest Big Data Vendor Revenue and Market Projections 2012-2017 study, details the segments that go to make up the Big Data marketplace, and projects Big Data revenues by segment out until 2017. A more detailed research professional alert looks at the Database segment of the Big Data Market.

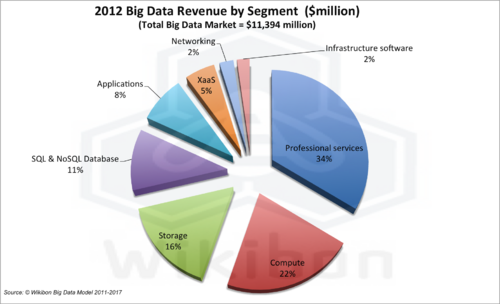

This report focuses on 2012 Big Data revenue by Vendor, and looks at the data from the Wikibon Big Data Model. The pie chart in Figure 1 shows the eight market segments that have been tracked and modeled by Wikibon, and which together make up the Big Data Market for 2012. This report is organized into eight sections, each of which provide an analysis by vendor of the market segment. The order of the segments in this report are by market size in 2012.

The overall Big Data market is estimated to be $11.3 billion, a growth of 58% over a revised 2011 figure of $7.2 billion. The Big Data market is projected to grow rapidly, with a growth of 59% in 2013, and 54% in 2014, before the market slows a little. The details can be found in the report links in the first paragraph, and from Table 1 in the footnotes.

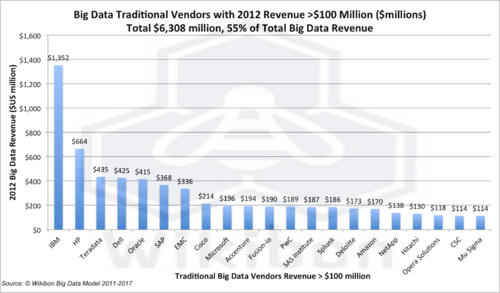

The leading traditional Big Data vendors by revenue are shown in Figure 2, and shows IBM as the leading vendor, with HP in a clear second place.

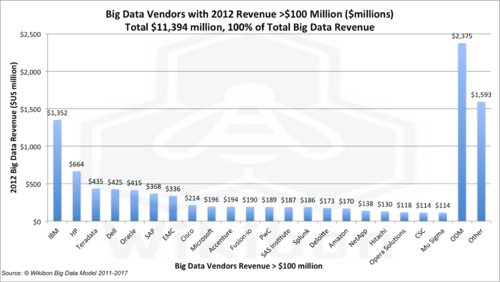

However, Figure 3 includes the largest contributor, the ODM's. These are companies which design and manufacture products specified by other organizations. All the major internet companies use ODM's, system integrators (SIs) and other integrators. The three-letter federal departments also utilize these organizations. The value contribution and profit margins are razor thin, and they rely on turning over capital many times a year to generate financial health and stability. Wikibon believes that ODM's and the long tail of other account for about 45% of the total market, and are a major channel for Intel, Seagate and Western Digital. This "consumer" approach to so much of the Big Data market puts real pressure on the traditional margins enjoyed by IT vendors.

Big Data Professional Services Segment by Vendor

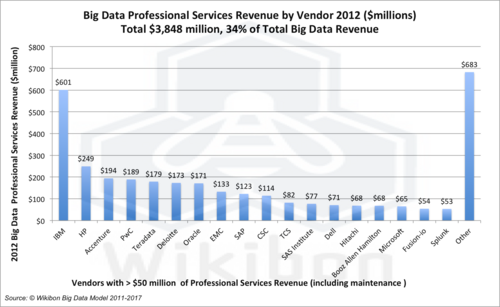

Figure 4 shows the major vendors in the largest segment of Big Data, accounting for $3.85 billion in revenue, 34% of the total Big Data market. Professional services include maintenance and break-fix on equipment, education and project work. Almost all the vendors have professional services revenue, and there is a long tail. IBM stands out in a clear first place, aided by a large and well informed services group and excellent brand marketing ("Smarter Planet" and Watson being outstanding examples).

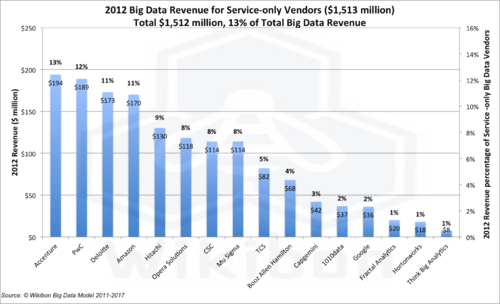

Just over a third of this market is captured by service-only vendors shown in Figure 5, with Accenture, PwC and Deloitte just ahead of a deep field.

Big Data Compute Segment by Vendor

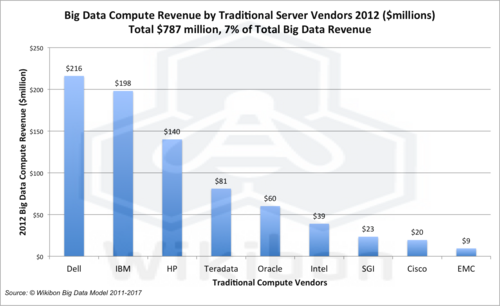

Figure 6 shows the traditional server market, this time will Dell in the lead (building on its success in HPC), IBM in second place and HP in third.

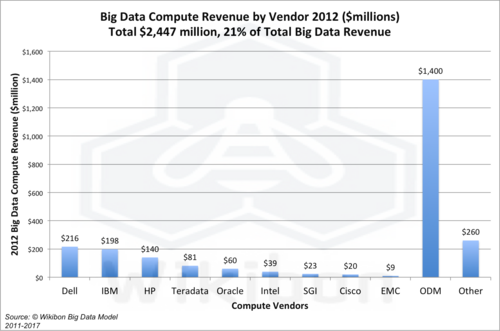

However, Figure 7 shows that Figure 6 was only dealing with one third of the compute market. ODM's dominate the server landscape in Big Data. Software-led Big Data infrastructure is likely to be build on standards such as Facebook's Open Compute and OpenStack, rather than traditional server vendors.

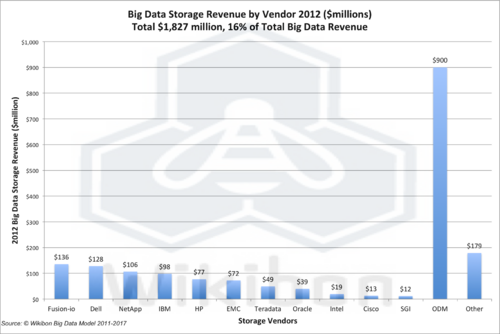

Big Data Storage Segment by Vendor

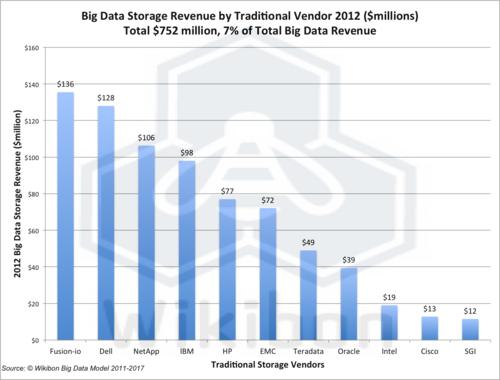

The same story is see in the Big Data storage segment. Figure 8 shows The traditional storage vendors, and shows Fusion-io in a leading position with the huge amount of flash storage it delivers in volume to Internet and other Big Data crunchers. Dell is in second place, and NetApp in third.

Similarly to the compute segment, Figure 9 includes ODM's, and shows the ODM's are taking storage components direct from Seagate, Western Digital and Intel, and shipping huge volumes with low margins. 58% of storage came from ODM's and the long tail of "Other". In response to this, Fusion-io is using its ioScale flash cards to create a low-cost hyperscale flash component for ODM's to include in Open Compute projects. This type of approach is required by vendors to stay relevant in hyperscale software-led infrastructure.

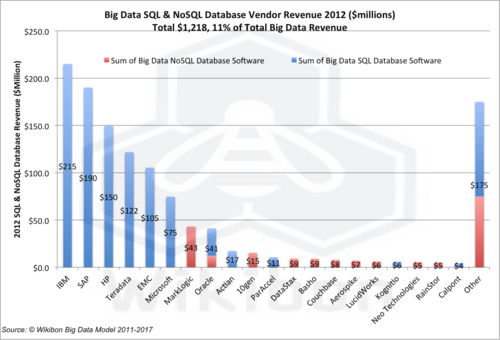

Big Data SQL & NoSQL Database Segment by Vendor

A more detailed research professional alert looks at the Database segment of the Big Data Market, and discusses in depth the different and distinctive roles the two types of database play. Figure 10 shows that SQLis dominant at the moment, with greater maturity and ease of programing. As data volumes in production grow, NoSQL is very likely to become increasingly important as the highly scalage, low-cost front-end elements of production Big Data.

The leading Big Data database vendors are IBM with its DB2 and Netezza products. SAP are in second place with its Sybase and HANA data-in-memory products. HP, with its Vertica SQL product, was third. Teradata and EMC fared well. MarkLogic was the best of the NoSQL vendors.

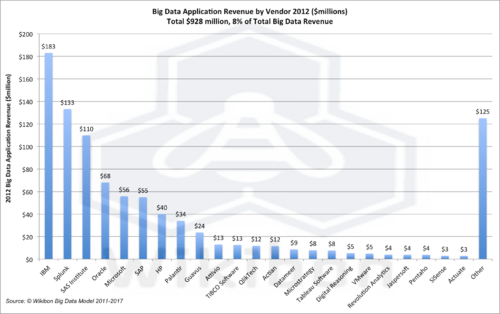

Big Data Applications Segment by Vendor

IBM is the leading vendor of Big Data application software, with 20% of the 2012 $928 million market place. Splunk are taking 14% and SAS 12% of the market. Wikibon found again a very long tail of application vendors who were competing both cross-industry and within vertical niches. There is clearly a vibrant and fast growing market of Big Data applications.

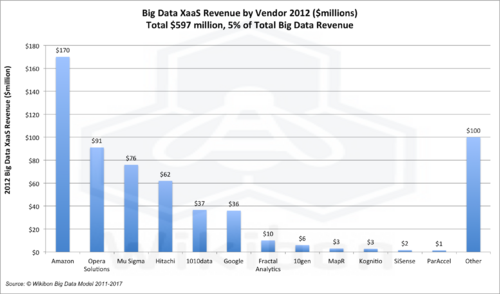

Big Data XaaS Segment by Vendor

The "as-a-service" vendors have one great advantage, the ability of offer very low entry prices to Big Data deployment. They also have one huge disadvantage, the requirement to bring data to the service. The movement of large quantities of data to a XaaS provider over a network is both costly and takes a lot of wall-clock time. Taking it out of services like Amazon is even more expensive. These services are ideal for development, and the Wikibon research has suggested that development and test dominate Amazon's results.

Amazon is first in the XaaS vendor with 28% of the $597 million market place. Opera Solution is second, and Mu Sigma third. Hitachi showed strongly by focusing on specific market segments. Google has announced strong network capabilities of bringing data across their own network, and offer very large potential deployments to customer, up to 10,000 virtual cores.

Minimizing the movement of data is clearly crucial to this segment. Wikibon found that large data centers such as SuperNAP near Las vegas are offering very good multi-carrier networking, but also are focusing on bringing together the cloud suppliers to a particular industry. The ability to back-haul data from one cage to another from XaaS service provider to another is a strong solution to the problem of data movement.

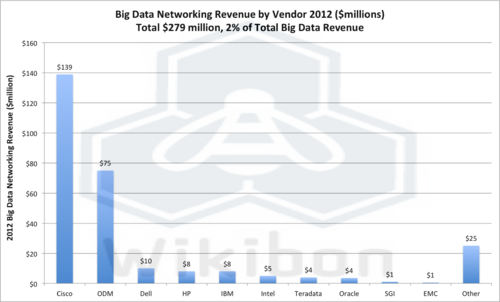

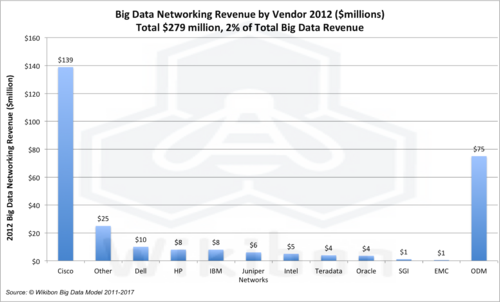

Big Data Networking Segment by Vendor

Cisco and the ODM's dominate the networking segment, with over 75% of the Big Data networking market. Find a discussion of how networking infrastructure and cloud are approaching the Big Data market in this SiliconAngle article and video What's the Impact of Big Data on IT Infrastructure.

Big Data Infrastructure Software Segment by Vendor

Most of the infrastructure software is open source, strong supported by the large internet players such as Facebook, Google and Yahoo. As a result the main revenue come from distribution in this segment. IBM, Oracle and Cloudera take the first three place.

Action Item: IT and business executives should be heartened at the investment in and growth of Big Data, and the wide variety of solutions available. Big Data is rapidly moving from startup to Big Business.