ServiceNow: Redefining Enterprise IT Service Management

From Wikibon

| Line 11: | Line 11: | ||

ServiceNow’s annual revenue is expected to be above $400M when the firm reports its full year 2013 results at the end of January 2014, a 60% growth rate over 2012. ServiceNow [http://www.valuewalk.com/2012/11/the-short-thesis-for-cloud-computing-company-servicenow-inc/ burned the shorts] in 2013, adding about $3B to its market value and maintaining a roughly 20X revenue multiple over its current market cap; leaving naysayers scrambling to cover their positions. ServiceNow has "poked the bear" of ITSM, specifically awakening established competitors. However, ServiceNow has the market momentum, vision, customer traction and technology architecture to maintain and even extend its lead through innovation and a maturing global ecosystem. Second half 2013 announcements address customer demands for purchasing services at a more granular level while at the same time expanding beyond core ITSM markets. | ServiceNow’s annual revenue is expected to be above $400M when the firm reports its full year 2013 results at the end of January 2014, a 60% growth rate over 2012. ServiceNow [http://www.valuewalk.com/2012/11/the-short-thesis-for-cloud-computing-company-servicenow-inc/ burned the shorts] in 2013, adding about $3B to its market value and maintaining a roughly 20X revenue multiple over its current market cap; leaving naysayers scrambling to cover their positions. ServiceNow has "poked the bear" of ITSM, specifically awakening established competitors. However, ServiceNow has the market momentum, vision, customer traction and technology architecture to maintain and even extend its lead through innovation and a maturing global ecosystem. Second half 2013 announcements address customer demands for purchasing services at a more granular level while at the same time expanding beyond core ITSM markets. | ||

| - | ServiceNow, however is not without challenges. A key issue facing the company is to not only growing its customer base but also embedding itself more deeply into existing accounts and extending beyond IT to validate its high valuation. [http://www.servicenow.com | + | ServiceNow, however is not without challenges. A key issue facing the company is to not only growing its customer base but also embedding itself more deeply into existing accounts and extending beyond IT to validate its high valuation. [http://www.servicenow.com A spate of announcements in 2013] was designed to accomplish this goal. Throughout last year, ServiceNow made moves to simplify its offering and deliver new services that facilitate the easier creation of applications. More recently, in the last two months of 2013, ServiceNow made several announcements that fortified its vision of “ERP for IT,” further automated configuration management, improved mobile support and importantly, extended ServiceNow beyond IT into HR service automation. |

With a modern platform, a focused offering and excellent sales execution, ServiceNow has injected life into the once-stagnant, slow growth ITSM market not only by bringing a SaaS business model to the table, but also re-defining how service management is done within enterprises. Wikibon has spoken to dozens of ServiceNow customers and consistently found that ServiceNow’s approach of delivering one code base, one user experience (UX), one data model and a “born in the cloud” mindset has been transformational for IT organizations. | With a modern platform, a focused offering and excellent sales execution, ServiceNow has injected life into the once-stagnant, slow growth ITSM market not only by bringing a SaaS business model to the table, but also re-defining how service management is done within enterprises. Wikibon has spoken to dozens of ServiceNow customers and consistently found that ServiceNow’s approach of delivering one code base, one user experience (UX), one data model and a “born in the cloud” mindset has been transformational for IT organizations. | ||

Current revision as of 15:26, 3 October 2023

Contents |

Introduction

ServiceNow (NYSE NOW) is one of the hottest companies in the software business with a current market value above $8B (Jan 2014). The firm has succeeded by modernizing the IT service management (ITSM) market through an innovative platform that is cloud-based and highly flexible. Initially conceived as an application development platform by founder Fred Luddy, the company targeted help desk and ITSM as a proving ground for its system, because as a former CTO of Peregrine Systems, he was familiar with that space.

The rest is history.

ServiceNow’s annual revenue is expected to be above $400M when the firm reports its full year 2013 results at the end of January 2014, a 60% growth rate over 2012. ServiceNow burned the shorts in 2013, adding about $3B to its market value and maintaining a roughly 20X revenue multiple over its current market cap; leaving naysayers scrambling to cover their positions. ServiceNow has "poked the bear" of ITSM, specifically awakening established competitors. However, ServiceNow has the market momentum, vision, customer traction and technology architecture to maintain and even extend its lead through innovation and a maturing global ecosystem. Second half 2013 announcements address customer demands for purchasing services at a more granular level while at the same time expanding beyond core ITSM markets.

ServiceNow, however is not without challenges. A key issue facing the company is to not only growing its customer base but also embedding itself more deeply into existing accounts and extending beyond IT to validate its high valuation. A spate of announcements in 2013 was designed to accomplish this goal. Throughout last year, ServiceNow made moves to simplify its offering and deliver new services that facilitate the easier creation of applications. More recently, in the last two months of 2013, ServiceNow made several announcements that fortified its vision of “ERP for IT,” further automated configuration management, improved mobile support and importantly, extended ServiceNow beyond IT into HR service automation.

With a modern platform, a focused offering and excellent sales execution, ServiceNow has injected life into the once-stagnant, slow growth ITSM market not only by bringing a SaaS business model to the table, but also re-defining how service management is done within enterprises. Wikibon has spoken to dozens of ServiceNow customers and consistently found that ServiceNow’s approach of delivering one code base, one user experience (UX), one data model and a “born in the cloud” mindset has been transformational for IT organizations.

The big question is how far can ServiceNow ride this wave?

How Did ServiceNow Become So Successful?

ServiceNow’s ascendency came well after it launched a SaaS-based ITSM product in 2004. At the time, ITSM products on the market were viewed as complicated, fragmented with high customer churn rates. Indeed many of the products on the market were viewed much in the same way that IT was perceived—non-responsive, stove-piped, misaligned (with business needs) and not value producing.

Two events occurred in the middle of the 2000’s, which created major tailwinds for ServiceNow. At the macro level, Amazon launched AWS, which kicked off a cloud craze and heightened awareness that perhaps the Salesforce.com model was right for a new breed of apps. As well it underscored that IT services in the future would be delivered on-demand, and as part of a service-oriented catalogue approach.

The second event was more nuanced. With the introduction of ITIL 2007, the ITIL methodology (which is the gold-standard for ITSM) evolved into a more holistic, full life-cycle approach. Of particular importance was the ITIL Service Strategy (SS) and the extension of the ITIL Service Catalogue, which dramatically widened the scope of ITSM processes. Practitioners of ITIL were immediately challenged to evolve their internal systems, but most offerings on the market were unable to keep pace and became rapidly viewed as outdated, rigid help desk tools.

ServiceNow was the exception. The company’s modern architecture, single code base and single data model, shared among all applications in the system, made it very easy for ServiceNow’s customers to adapt its platform to business requirements and new ITIL processes. As with virtually all products on the market, ServiceNow started by managing incidents, problems and changes within IT as part of an overall release governance process. But in the middle of the decade, ServiceNow started to knock down blue chip customers in the Global 2000 and rapidly became the Salesforce.com of IT. Today, ServiceNow, along with Workday, are considered the next big enterprise software plays mimicking the Salesforce SaaS playbook; albeit in different markets with different architectural approaches.

Notably, unlike SaaS players such as Salesforce and Workday, which sell into the lines-of-business, ServiceNow sells almost exclusively to the IT department. Its strategy is to automate the service processes that IT touches and create an alluring platform that other business processes can easily adopt. ServiceNow’s mantra is to make IT people “heroes” within their companies. Discussions with dozens of ServiceNow customers confirm that this strategy is working.

The big questions observers are asking about ServiceNow today include:

- Is the company’s lofty valuation justified?

- How large is ServiceNow’s market?

- Does ServiceNow’s laser focus on Global 2000 customers limit its market size?

- Will competitive responses to ServiceNow’s model limit its growth prospects?

- Is ServiceNow’s architecture truly modern and differentiable?

- Can ServiceNow compete successfully as a so-called PaaS player?

This Professional Alert will address these questions and put forth Wikibon’s view of ServiceNow’s prospects going forward.

Does ServiceNow’s TAM Justify its Valuation?

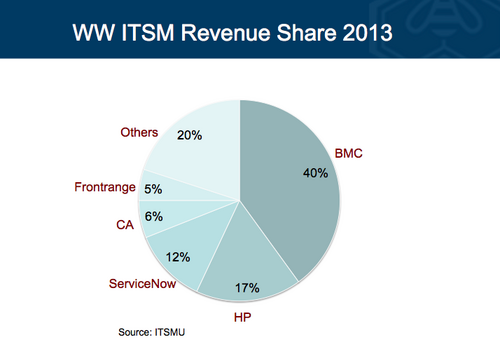

At the end of September 2013, ServiceNow had about 1,900 customers or just under 16% of the 12,000 large enterprises that it targets. Various estimates indicate the company has between 10%-12% of the ITSM space, which is a slow growth market. ServiceNow, much like Workday, has been rapidly gobbling share to power its growth in a market once viewed as stagnant. The company’s “logo slide” is impressive and growing rapidly.

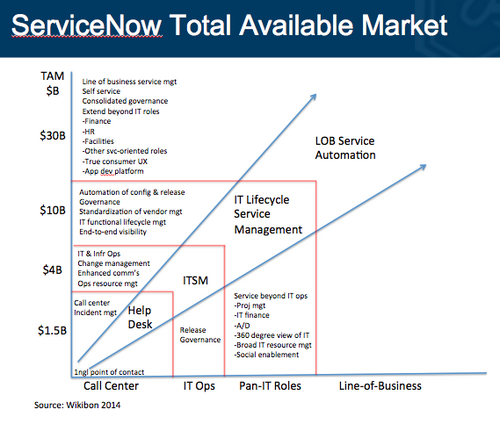

However if ServiceNow’s TAM is narrowly defined as the ITSM market, it would appear the company’s valuation is far too high. The ITSM space according to research firms like Gartner is approximately $4B annually. Even at 100% share, ServiceNow’s current valuation wouldn’t hold water.

So why are investors so excited about ServiceNow’s prospects, and why is the company’s valuation escalating? We see six primary factors driving ServiceNow’s valuation momentum, specifically:

- Growth: Investors are starved for growth companies in enterprise tech – especially software firms -- and suppliers like Salesforce, ServiceNow, Workday, Splunk and Tableau are viewed as highly attractive because they are growing rapidly and disrupting existing markets with the marginal economics of software business models.

- Cloud: Cloud computing is viewed as disruptive and transformative. Companies that have successfully drafted off the momentum of both Salesforce.com and Amazon AWS are commanding a premium from investors because their revenue streams are predictable and their business models are alluring.

- Platform: ServiceNow has a platform that Wikibon has called “flat,” meaning all application modules access the same data model. In our opinion, this means its architecture is highly flexible and can be easily extended beyond the ITSM space.

- Management: Simply put, the market views founder Fred Luddy as a visionary and CEO Frank Slootman as an execution guru; with a proven track record of creating new markets and outselling much larger and better-funded competitors.

- Customer Fanaticism: ServiceNow customers are incredibly supportive of the company. At its Knowledge conference in 2013, ServiceNow held its annual financial analysts meeting and Wall Street saw, first hand, the degree to which its customers love the company and its products.

- Markets Beyond ITSM: IT now touches virtually every part of the business, and to the extent that ServiceNow’s platform can extend into line-of-business domains, we believe its TAM will expand dramatically.

Deeper Discussion on the ServiceNow TAM

The total market size in which ServiceNow participates requires further discussion and has always been a point of concern for investors. ServiceNow CFO Mike Scarpelli has conservatively pegged the markets including and beyond the straight ITSM space at $8B, citing analysts who believe it could be as high as $20B. In our view the TAM is much larger – closer to $30B. Whether ServiceNow can attack that entire space given its bias toward larger companies remains to be seen, but the overall market, we believe, has more potential than many realize.

Moreover, we believe that ServiceNow is gaining traction because it is cutting cost and improving productivity within IT operations. We strongly feel that ServiceNow’s market is bigger than traditional definitions of ITSM because as it helps customers become more productive, they invest more in the platform—driving new incremental productivity and creating a “flywheel” effect (better product→increased productivity→lower marginal costs→leads to further platform investments).

To the extent ServiceNow can apply this model beyond traditional ITSM it will, we predict, create incremental market opportunities.

Specifically, ServiceNow came out of the blocks positioning itself beyond help desk and now is reaching beyond ITSM with a concept it calls “ERP of IT.” This TAM expansion strategy is attractive for investors and differentiable from the competition.

What does ERP for IT mean, and is it more than just a marketing tagline? In concept ERP for IT means going beyond incident, problem and change management and into a more holistic view of IT operations. So in other words, not just supporting those in IT who are managing the incidents but also supporting project management, vendor management, software development and deployment, and rolling out and managing infrastructure through a full life cycle.

Notably, last year, ServiceNow announced App Creator, a capability to easily build new apps that can, by default, share the single data model concept. This, we believe will further expand the company’s TAM as the potential of this concept goes beyond IT. The reality is that HR functions, facilities, marketing and other business lines have similar dynamics for handling requests. For example, ServiceNow recently announced capabilities to automate HR service delivery. Importantly this is complementary to an HR system like Workday, which houses all the benefits, pay scale and personnel details. What ServiceNow does is provide a means of delivering HR services along with other company services as part of an overall catalogue. It provides self-service capabilities across the company that are both measurable and governable.

As a result, we believe that ServiceNow’s TAM is significantly larger than existing markets and extends beyond IT – see Figure 2:

Questions remain as to how much of that $30B TAM ServiceNow can address. Generally it leaves smaller customers for its ecosystem to service or cedes them to competitors specifically focused on SMB. This does limit ServiceNow’s addressable market. However ServiceNow’s strategy of going after the Global 2000 is the correct one because these are the customers with the most difficult problems. Once ServiceNow cracks the IT department it can pursue other divisions within large companies—both IT and line-of-business.

Competitive Outlook

ServiceNow competes almost exclusively in enterprise markets, focused on Global 2000 customers. Its biggest competitor is BMC Software, which offers a set of legacy ITSM products and also its Remedy OnDemand offering. BMC is a 20-year leader in the ITSM space with deep integration expertise, a strong ecosystem and a large installed base that it’s fighting to protect. BMC customers Wikibon has spoken with suggest that its products are very functional but complex.

More than 20 companies participate in the ITSM market, including large incumbents like HP, CA and IBM. Traditionally products in this market have been dubbed as cumbersome, expensive, inflexible and outdated. ServiceNow (and others) changed that perception by delivering SaaS-based solutions that were more flexible and offered other benefits associated with on-demand software. Companies like Cherwell Software have demonstrated there’s room for smaller pure plays to emerge. In the large-enterprise ITSM SaaS space, however, only BMC, ServiceNow and Cherwell are showing meaningful traction – underscoring the difficulty of competing in the enterprise segment.

Generally the large incumbents are moving toward a SaaS model and face similar challenges as other established software companies in this transition. Specifically, moving from a large up-front perpetual license/ongoing maintenance model to a monthly revenue stream causes angst among stakeholders. BMC went private in September 2013 while larger players like HP, CA and IBM can somewhat hide their transitions within a much larger software portfolio. Nonethless, the market is being disrupted, and longer term putting a SaaS face on a legacy backend is not likely to be a winning strategy.

The SMB market is much more fragmented, and while ServiceNow is not a player in the lower-end market spaces there are two varying views on this opportunity. On the one hand, conventional wisdom suggests that it’s easier to go up market than come down. On the other hand, ITSM, ITIL and service management governance is generally not a top priority of small business owners. However to the extent products in this market can be simplified, they may have an impact longer term.

Figure 3 below shows recent market share data on the ITSM market from the ITSMU. As is shown in the data, ServiceNow’s focus on the Global 2000, thus far has shown to be the right strategy.

What About Mobile?

Mobile is a megatrend in the application space, and the ITSM market is no exception. Making applications work in mobile is difficult for many developers, because it requires a different mindset and low level programming expertise. The advent of HTML5 has positively changed this dynamic. Coming into 2013, Wikibon had concerns about the pace of mobile development in ITSM generally and ServiceNow specifically. Last spring ServiceNow made a rather narrow announcement to support iPad only. But last November, the company mobilized its entire application.

We view this as both industry-leading and critical to TAM expansion. Specifically, because ServiceNow’s strategy is to enable developers to very easily build applications on its platform with App Creator, every app that’s built will automatically be mobile enabled. This is attractive for developers and is a strategy being pursued by leading platform ISVs.

Is ServiceNow’s Architecture Truly Modern or Just Good Marketing?

Critics of ServiceNow point to the fact that its architecture is not multi-tenant. Technology purists will argue this approach is outdated and adds complexity that will have ripple effects on customer upgrades.

We believe this argument misses the point. Specifically, Wikibon has always stated that from a customer standpoint the single vs. multi-tenant argument is irrelevant. In our view, multi-tenancy is nice for the vendor, who can "oversubscribe" and share resources (think amazon AWS), but from a buyer's standpoint it doesn't matter. In fact many customers understand that from a security perspective (similar to Larry Ellison's argument at Oracle OpenWorld 2012), multi-tenancy done at the application level is more risky.

The nuance here is that the ServiceNow architecture is multi-instance, which makes it a hybrid of sorts with the cost efficiencies of multi-tenancy and security of single-tenancy. ServiceNow’s architecture separates customer data and applications through logical isolation while leveraging virtualization techniques to share hardware.

The upgrade issue is also a specious argument because ServiceNow has demonstrated consistently that it has an automated process to manage upgrades. A key ingredient of the secret sauce of automating services is having an accurate model of what the IT infrastructure actually looks like behind the business services and mapping the relationship between those business services and the IT infrastructure components. This is a core discipline of ServiceNow.

In classic ServiceNow fashion, it has recently made available portions of its own internal orchestration engine to customers in a recent announcement around configuration automation. In a partnership with Puppet Labs, ServiceNow uses Puppet’s open source toolset to enable visibility and control into the nitty gritty details of the compute, storage and networking infrastructure. Specifically, Puppet allows configuration management using a model-based store called a “Puppet Master.” Puppet understands the configuration of record data for all the different types of servers in the enterprise (e.g. DB servers, Web servers, Linux, Windows, etc). Puppet manages those configurations at a very large scale. ServiceNow connects to Puppet and takes control, allowing ServiceNow to become the single authority over the change management process and be directly connected to changes in a Puppet controlled environment. This degree of automation is critical to allow ServiceNow and its customers to scale.

The bottom line is the advantages of a single, shared data model (i.e. that “flat” architecture we referenced earlier) far outweigh the religious debates of single vs. multi-tenancy. The ability to easily add function and allow all modules to access the same data have allowed ServiceNow to rocket into a leading position. The real challenge for ServiceNow over time will be to manage locking rates on the single data model at scale. As ServiceNow and its customers add more apps that share the same data model, classic database queuing theory will kick in and create interesting architectural challenges for ServiceNow engineers. However these issues are well-understood in computer science circles, and ServiceNow will be able to evolve its architecture for a long period of time.

What to Watch Going Forward

ServiceNow’s execution to date has been stellar. Its growth rates, ability to attract and retain talent, its technical approach and customer loyalty have made it a darling on Wall Street and amongst customers. Moreover, management has the confidence of investors and has put forth an ambitious plan to re-define ITSM and take the disciplines of IT process management further into line-of-business units. In our view this is critical and is by no means a certainty. Many uncharted waters remain for ServiceNow, and observers, investors and customers should focus on the following seven high-level areas as indicators of continued success:

- Growth: ServiceNow’s valuation is largely a function of its ability to grow by gaining share in a once-stagnant market. Both new customer acquisition and deeper penetration into existing accounts with higher net contract values are key performance indicators.

- TAM Expansion: A key component of growth must come from expanding (and of course serving) the TAM into lines of business. ServiceNow’s current market cap cannot be justified solely on the traditional ITSM market. Professional services and acquisitions are two areas to watch, but these are tricky as partners want to keep some services revenue and acquisitions must generally fit into the single data model construct.

- Competition: Competitors' ability to steal ServiceNow’s playbook is a constant threat. Virtually all established competitors are moving to a SaaS model with a “we have that too” marketing message. The question is: Are they simply putting a SaaS face on legacy software or truly transforming? And even if the former, will ServiceNow be able to continue to wrestle customers away from large suppliers at rapid pace?

- Scale: ServiceNow engineers are betting that its architecture can compete for decades going forward. ServiceNow is not your typical hyperscale Web giant, and it must demonstrate that it can maintain high quality service levels at a scale that justifies its TAM.

- A New Kind of PaaS: ServiceNow is not in our view competing directly with PaaS players like Salesforce, Amazon, Google or Pivotal. Rather it is leveraging relationships with IT and making apps simple to build. So in essence its strategy is to make ServiceNow a new type of application development platform, with a mainspring from traditional IT. The key metric to watch is how fast organizations will develop apps on ServiceNow’s platform and how quickly it can build its developer base.

- Ecosystem: Any platform player needs a strong ecosystem, and ServiceNow’s is growing. Pay attention to the number of players and their monetization opportunities as good indicators of long-term success.

- Customer Loyalty: In Wikibon’s view, ServiceNow customers are perhaps the most vocally thrilled of any company we’ve ever seen in terms of voicing their utter pleasure with a vendor. To what degree can ServiceNow maintain that loyalty as it expands its TAM.

On balance we believe market tailwinds, combined with ServiceNow’s execution to date, technical and management prowess, sales effectiveness and customer loyalty put it in an excellent position to continue to grow at a rapid pace, create new markets and add significant value to stakeholders.

Action Item: For years, IT service management has suffered the "Cobbler's Children" syndrome in technology departments, with revenue-producing initiatives consistently trumping investments in ITSM. ServiceNow has radically changed the perception of of ITSM and is demonstrating that a flexible, SaaS-based, single data model system--where all service modules have access to the same data--can drive significant business value. Practitioners struggling with inefficient and non-agile ITSM processes should investigate ServiceNow and similar platforms and/or challenge incumbent ITSM suppliers to deliver similar organizational outcomes.

Footnotes: