Big Data Market Size and Vendor Revenues

From Wikibon

| Line 10: | Line 10: | ||

[[Image:BigDataMarket.png|center|thumb|500px|Figure 1 - Source: Wikibon 2012]] | [[Image:BigDataMarket.png|center|thumb|500px|Figure 1 - Source: Wikibon 2012]] | ||

| + | |||

| + | Of the current market, Big Data pure-play vendors account for over to $245 million in Big Data-related revenue. Despite their relatively small percentage of current overall revenue (approximately 5%), however, Big Data pure-play vendors – such as Vertica, Splunk and Cloudera -- are responsible for the vast majority of new technologies and modern approaches to data management and analytics that have emerged over the last several years and made Big Data the hottest sector in IT. | ||

| + | |||

| + | Wikibon considers Big Data pure-plays as those independent hardware, software or services vendors whose Big Data-related revenue account for 50% or more of total revenue. This group also consists of three until-recently independent Next Generation Data Warehouse vendors – HP Vertica, Teradata Aster, and EMC Greenplum – who largely continue to operate as autonomous entities and have not, as of yet, had their DNA polluted by their acquirers. | ||

| + | |||

| + | Below is a revenue breakdown of the top Big Data pure-play vendors as of February 2012.* | ||

| + | |||

| + | [[Image:BigDataMarket2.png|center|thumb|500px|Figure 2 - Source: Wikibon 2012]] | ||

Revision as of 16:35, 10 February 2012

By Jeff Kelly with David Vellante and David Floyer

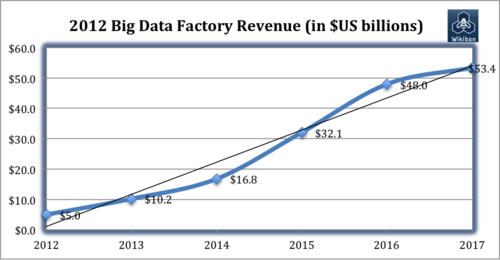

The Big Data market is on the verge of a rapid growth spurt that will see it top the $50 billion mark within the next five years, according to a detailed analysis by Wikibon.

As of early 2012, the Big Data market stands at just under $5 billion based on related software, hardware and services revenue. Increased interest in and awareness of the power of Big Data and related analytic capabilities to gain competitive advantage and to improve operational efficiencies, coupled with developments in the technologies and services that make Big Data a practical reality, will result in super-charged CAGR growth rate of 58% between now and 2017.

As explained in our Big Data Manifesto, Wikibon believes Big Data is the new definitive source of competitive advantage across all industries. For those organizations that understand and embrace the new reality of Big Data, the possibilities for new innovation, improved agility, and increased profitability are nearly endless.

Below is Wikibon’s five-year forecast for the Big Data market as a whole:

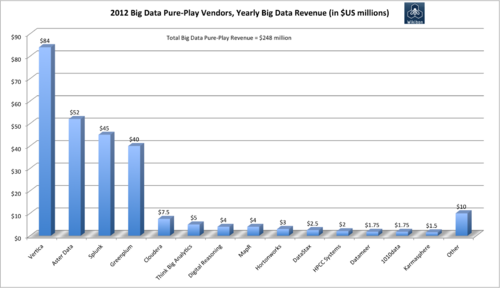

Of the current market, Big Data pure-play vendors account for over to $245 million in Big Data-related revenue. Despite their relatively small percentage of current overall revenue (approximately 5%), however, Big Data pure-play vendors – such as Vertica, Splunk and Cloudera -- are responsible for the vast majority of new technologies and modern approaches to data management and analytics that have emerged over the last several years and made Big Data the hottest sector in IT.

Wikibon considers Big Data pure-plays as those independent hardware, software or services vendors whose Big Data-related revenue account for 50% or more of total revenue. This group also consists of three until-recently independent Next Generation Data Warehouse vendors – HP Vertica, Teradata Aster, and EMC Greenplum – who largely continue to operate as autonomous entities and have not, as of yet, had their DNA polluted by their acquirers.

Below is a revenue breakdown of the top Big Data pure-play vendors as of February 2012.*